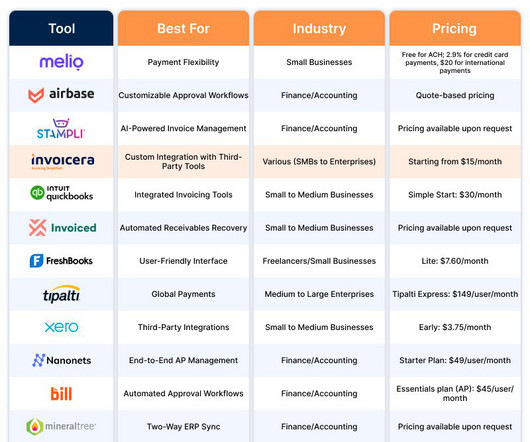

13 Best Accounts Receivable and Accounts Payable Software

Invoicera

NOVEMBER 8, 2024

For many companies, managing accounts receivable (AR) and accounts payable (AP) is a constant challenge, with delayed payments, manual errors, and lack of real-time visibility causing significant disruptions. are paid late, impacting the financial health of businesses. This blog will highlight: Potential AR and AP management issues.

Let's personalize your content