Essential Standards for Your AR Team

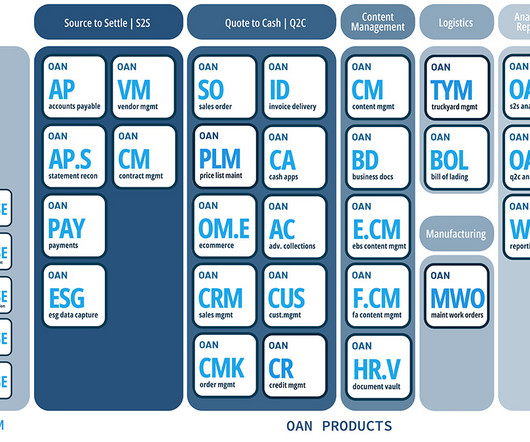

oAppsNet

NOVEMBER 1, 2024

Your Accounts Receivable (AR) team is your business’s critical cash flow driver. With a high-performing AR team, your business can expect accelerated payments, improved cash flow, and a reduced risk of falling behind on bills, payroll, and growth opportunities. But what separates an average AR team from a high-performing one?

Let's personalize your content