The difference between bank balance and book balance

Accounting Tools

MAY 4, 2024

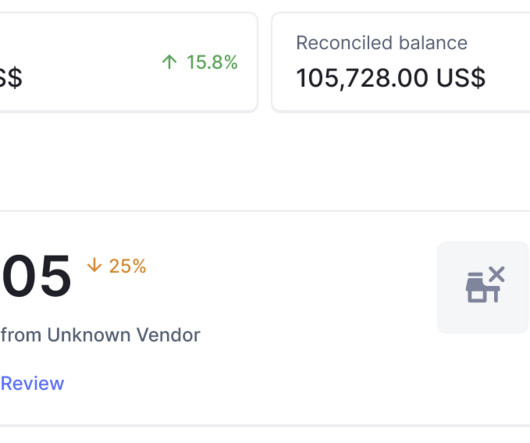

What is the Book Balance? The book balance is the in-house general ledger record of the same account. Comparing the Bank Balance and Book Balance There are multiple differences between the bank balance and book balance, which are as follows: Checks outstanding. Unrecorded fees.

Let's personalize your content