Bad debt expense definition

Accounting Tools

MAY 10, 2024

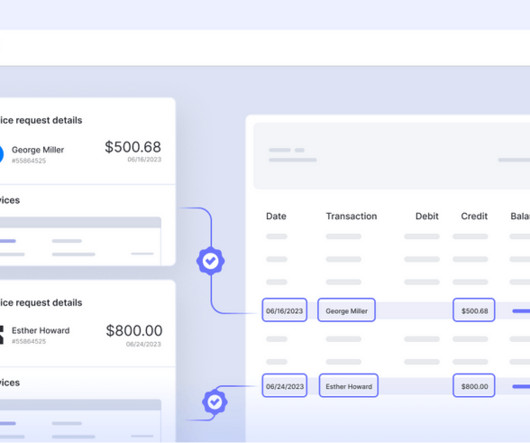

What is Bad Debt Expense? Bad debt expense is the amount of an account receivable that cannot be collected. This is a debit to the bad debt expense account and a credit to the accounts receivable account. This is a debit to the bad debt expense account and a credit to the accounts receivable account.

Let's personalize your content