Understanding Internal vs. External Audits: A Guide for SME Owners in Singapore

Counto

DECEMBER 16, 2024

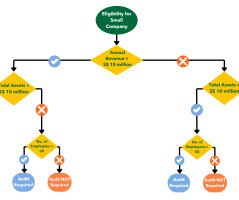

Understanding Internal vs. External Audits: A Guide for SME Owners in Singapore Audits are critical tools for evaluating a companys financial health and operational efficiency. While both audits provide valuable insights, they differ in their objectives, scope, and who performs them. What is an Internal Audit?

Let's personalize your content