Record Keeping Requirements for New Businesses in Singapore

Counto

JANUARY 10, 2024

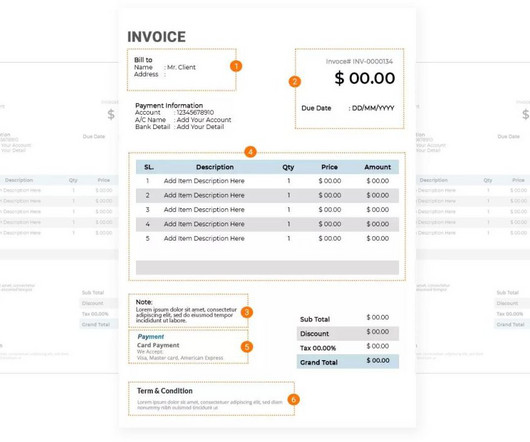

Record Keeping Requirements for New Businesses in Singapore For new businesses in Singapore, proper record-keeping is not just a good practice—it’s a legal requirement. What Records Must Be Kept? Refer to this Record Keeping Checklist for a list of the different types of records required.

Let's personalize your content