Understanding Bank Reconciliation Journal Entries

Nanonets

APRIL 17, 2024

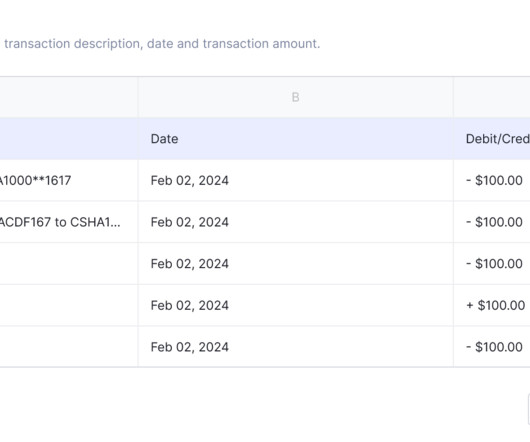

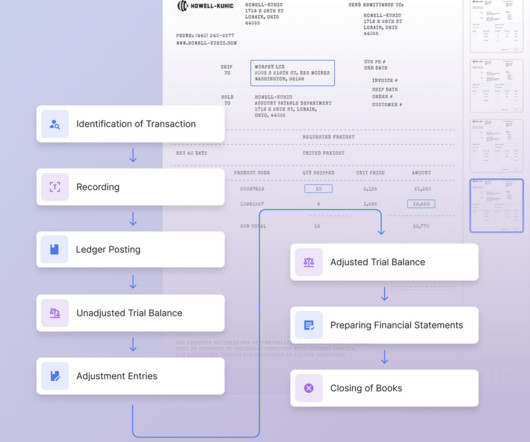

Introduction to Bank Reconciliation Journal Entries Bank reconciliation is an important process in accounting that ensures the accuracy and integrity of a company's financial records. It involves the comparison between the company’s internal financial records and those of the bank.

Let's personalize your content