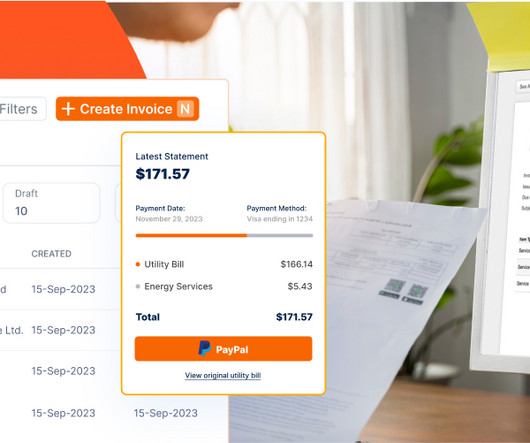

Bookkeeping Solutions for Freelancers

Less Accounting

JANUARY 17, 2024

Freelancers are famous for their ability to run an entire business independently. Unless you’re a freelancing bookkeeper, bookkeeping is one task that often falls by the wayside. That’s why finding the right bookkeeping for freelancers can make or break your small business.

Let's personalize your content