The Benefits of Bookkeeping for Budgeting and Financial Planning

Bookkeeping Express

APRIL 19, 2023

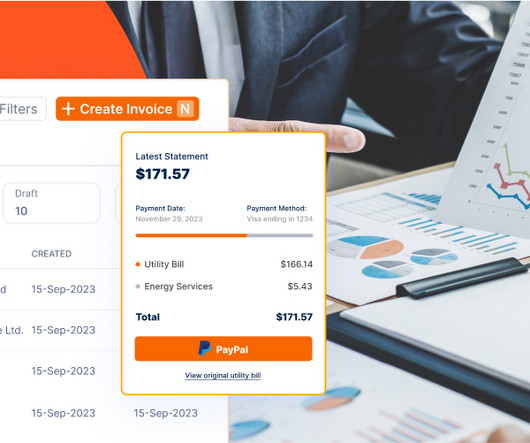

A truly quality bookkeeping process offers so much more, however, particularly when it comes to budgeting, financial planning, and being able to make timely changes as time passes and circumstances change. Delayed data entry can lead to inaccurate financial reports, which can mislead businesses in their decision-making process.

Let's personalize your content