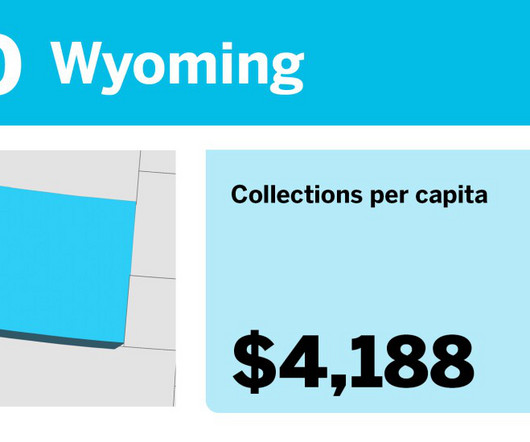

20 states that collect the most tax per capita

Accounting Today

JULY 18, 2024

The top state takes in $7,200 in tax per capita.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Accounting Today

JULY 18, 2024

The top state takes in $7,200 in tax per capita.

Accounting Today

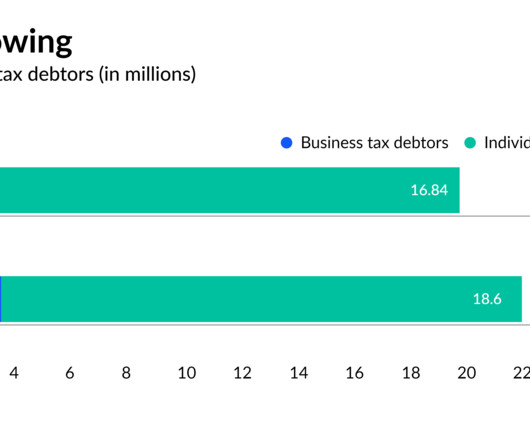

JULY 11, 2024

The agency is hoping to counter a widespread impression that people can get away without paying their taxes, according to Commissioner Werfel.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Live Demo - Supercharge your Month End Close

Doing More With Less: The Modern Finance Miracle

The Hidden Science Behind Why Finance Teams Resist Change—And How to Fix It

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Accounting Today

SEPTEMBER 14, 2023

IRS data and changes to collection operations over the past four years show 10 clear effects.

Live Demo - Supercharge your Month End Close

Doing More With Less: The Modern Finance Miracle

The Hidden Science Behind Why Finance Teams Resist Change—And How to Fix It

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Accounting Today

JANUARY 31, 2024

Tax pros and taxpayers should be aware that the IRS is restarting its 'collection notice stream.'

Accounting Today

MAY 6, 2025

More than 3,600 revenue agents responsible for collecting tax payments have left the IRS.

Accounting Today

SEPTEMBER 20, 2023

The top three states had an average change percentage of 215.76% between 2021 and 2022.

Accounting Today

OCTOBER 16, 2023

The Internal Revenue Service is trying to leverage the extra funding to collect more taxes, but has spent surprisingly little so far.

Accounting Today

SEPTEMBER 19, 2022

(..)

Accounting Today

MARCH 31, 2025

Tax collection projections are down. Refunds are up. That's a formula that could dampen U.S. government revenue.

Xero

DECEMBER 4, 2023

When it comes to manual tasks, there are few that are more burdensome than sales tax. Automate your sales tax calculations in Xero Auto sales tax brings advanced sales tax management directly into Xero, helping you automate sales tax calculations, reporting and filing. But we have some great news.

Xero

APRIL 28, 2025

Imagine seamlessly managing, reviewing, and completing your bookkeeping, workpapers and tax all in one place. This means less tedious work leading to faster review and finalisation of client accounts, tax returns, and financial statements. What does this mean for your practice?

Accounting Today

SEPTEMBER 11, 2024

The OZ program allows investors to defer their capital gains from sales of appreciated real estate, stocks, businesses, personal residences, collectibles and even crypto through 2026.

Accounting Today

MAY 23, 2024

The Internal Revenue Service doesn't collect data on taxpayers' race or ethnicity, but some of its methods could lead to disparities in its audit rate.

Intuit

APRIL 21, 2025

Tax professionals, like doctors and attorneys, have many specialized acronyms and designations. An enrolled agent is a tax professional that provides tax planning, tax advice, and also files tax returns. EAs are qualified to focus on tasks like tax collections, tax audits, and tax appeals.

Accounting Today

DECEMBER 26, 2024

Private collection agencies have recovered only about $2.4 billion in tax debt payments since April 2017 out of the $64.9 billion assigned to them by the IRS.

Accounting Today

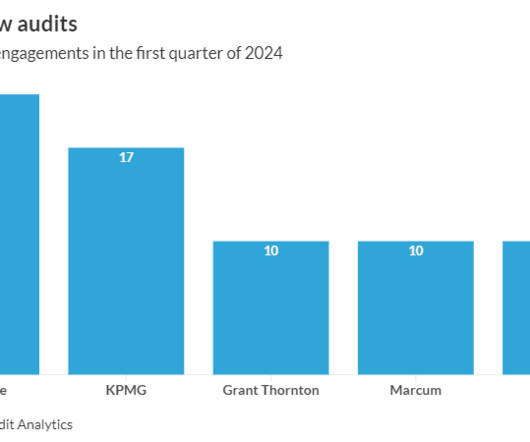

JANUARY 12, 2024

The Internal Revenue Service reported progress Friday on its efforts to increase its audits of large corporations, complex partnerships and high-income individuals, collecting over half a billion dollars from millionaires who didn't pay their taxes.

Accounting Today

SEPTEMBER 26, 2024

Accountants weigh in on which companies have cyber vulnerabilities, states with the highest tax collections per capita and other key metrics.

Accounting Today

JULY 15, 2024

Wolters Kluwer announced CCH Tagetik Tax Provision & Reporting, a solution offering data collection and group tax provision calculations for multinationals.

Accounting Today

AUGUST 22, 2023

The top three types had an average increase in gross collections of 39.86% between 2021 and 2022.

Accounting Today

DECEMBER 23, 2024

The money will help it expand from payments and collections to a broader practice management platform, and to develop a tax solution.

Intuit

APRIL 8, 2025

financial planners, CPAs) 33% are investing solo 47% are filing taxes using DIY tools like TurboTax They’re not chasing perfectiontheyre building resilience and financial confidence. Day-to-day costs are also top of mind. As part of this survey, key questions were revisited from Intuit’s 2023 Prosperity Study.

Intuit

MARCH 26, 2023

Taxes can be confusing. Intuit has helped tens of millions of families and small businesses take charge of their finances by helping them understand, prepare, and file their tax returns confidently—millions of them for free. That’s when he decided to try Intuit TurboTax—and found not just tax help, but people who cared.

Accounting Today

JUNE 6, 2025

The company also announced new tax workflows and features. All rights reserved. Avalara launches APIs for 1099, W-9 solutions Scott McFarlane, chief executive officer of Avalara Inc.,

Accounting Today

DECEMBER 5, 2023

Key justices suggested the tax, which aimed to collect hundreds of billions of dollars on a one-time basis, wasn't fundamentally different from other levies imposed by Congress over the years.

Accounting Today

SEPTEMBER 19, 2024

Three people shared the award after disclosing an offshore tax-evasion scheme that spanned 15 years, enabling the IRS to collect $263 million from an unidentified individual.

Accounting Today

JULY 12, 2023

The Internal Revenue Service has been sending out erroneous balance due notices demanding taxpayers in federal disaster areas pay up, even though they're supposed to get extra time.

Accounting Today

JUNE 9, 2025

Gary Boomer June 9, 2025 10:00 AM Facebook Twitter LinkedIn Email As CPA firms grow into the $10 million to $100 million revenue range, operational complexity increases, especially during peak periods like tax season. Identify opportunities Assess pain points in tax, audit, scheduling, and advisory workflows. All rights reserved.

Accounting Today

DECEMBER 4, 2023

The case coming before the court stems from a 2017 tax law provision that aimed to collect hundreds of billions of dollars on earnings accumulated and held overseas by big multinational companies.

Intuit

JANUARY 8, 2025

Having a clear plan of action , along with researching available tax deductions and credits , can significantly aid your path to homeownership and ensure you are making the most financially sound decisions on your journey. This dream can still be a reality for younger generations. Respondents received remuneration.

Xero

AUGUST 7, 2024

Avalara Avalara helps businesses of all sizes get tax compliance right, no matter where in the world they run their business. Dext Dext provides bookkeeping automation tools that help small businesses and their advisors collect, organize and record financial transactions.

Accounting Today

DECEMBER 20, 2023

million taxpayers who weren't sent collection reminder notices during the pandemic. The relief will go to roughly 4.7

Accounting Today

JANUARY 4, 2023

(..)

Accounting Today

NOVEMBER 28, 2023

Deploying 1,400 tax collectors — touted by the government as "paramilitary trained" in order to discourage resistance — is the most aggressive in a long line of controversial steps to nearly double the government's revenue collection to a quarter of gross domestic product by 2030.

Accounting Today

APRIL 21, 2025

Tax collections are confirming Wall Street forecasts that the U.S. government will not exhaust its borrowing capacity until later this year.

Accounting Today

JUNE 9, 2025

The offer on display from smart money is tempting — access to liquidity much sooner, with better tax treatment, and the chance for "multiple bites at the apple," with resources to fuel future value creation. All rights reserved.

LedgerDocs

JULY 6, 2023

But collecting and organizing these documents can be a daunting task. The post Bookkeeping Document Checklist: Collect and Organize Your Financial Documents appeared first on LedgerDocs. Accurate record keeping can help you to remain organized, compliant and gain insight into the financial position of your business.

LedgerDocs

MARCH 23, 2023

As a bookkeeper or accountant for a Canadian business, it is important to stay on top of the tax-related documents that need to be prepared for to ensure compliance with Canada’s taxation laws. So, what documents should bookkeepers or accountants of Canadian business owners be aware of to collect during tax season?

Xero

NOVEMBER 27, 2022

Innovation in accounting technology has been constant in the last decade, from the mass adoption of cloud accounting, to tax digitalisation with Making Tax Digital (MTD), to Open Banking. Find out why MTD for ITSA is great. This is why we’re hosting a panel titled: MTD for ITSA is great! Yes, we said it!

Xero

AUGUST 7, 2023

Whether you’re looking for tools to chase invoice payments, simplify tax compliance, or make job management easier, you’ll find plenty of solutions to help solve those key business challenges. GoCardless GoCardless puts you in control of collecting payments directly from your customers.

LedgerDocs

FEBRUARY 25, 2025

Tax season 2025 is fast approaching, and for bookkeepers and accountants, staying on top of the important corporate tax deadlines is the key to completing smooth filings for their clients. Canadian-Controlled Private Corporations (CCPCs) that meet specific criteria may have three months to pay taxes owing for the year.

Xero

MAY 31, 2022

We will automatically calculate Schedule 5 or PAYG tax and display the leave loading on the employees’ payslip. Map incomplete tax rates in Xero — Canada. If you have unmapped tax rates in Xero, the incomplete tax rates will now be grouped at the top of the tax rates page.

Xero

JUNE 16, 2022

However, this can be made easier by collecting payments on-site, rather than after. . It collects feedback and insights on employee sentiment using the Shift Engagement feature, helping small business owners and managers take action to bolster their team’s wellbeing. Are you planning to hire in the new financial year?

Intuit

APRIL 21, 2025

Taxation and Regulation (REG): Business law, federal taxes, ethics, and legal and professional responsibilities all fall under this section. This section is valuable for those aspiring to work in tax-related fields, whether in public accounting, private industry, or government. Thats roughly 2,000 hours of practical experience.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content