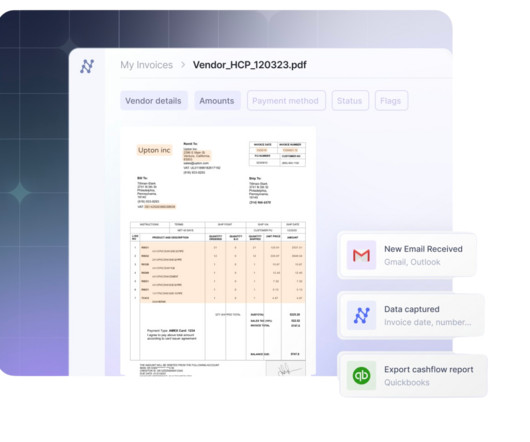

The complete guide to invoice reconciliation for your business

Nanonets

JUNE 22, 2023

Whether you are a small business or a large enterprise, reconciling invoices is an essential process to ensure accuracy, identify discrepancies, and maintain strong financial controls. Client and partner retention Accurate and reconciled numbers are essential for building and maintaining solid relationships with vendors and suppliers.

Let's personalize your content