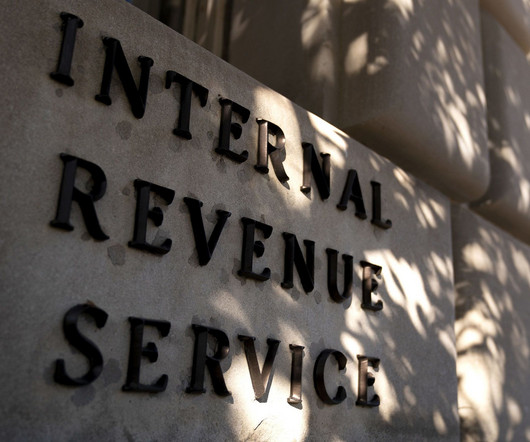

IRS tries to use AI to close tax gap

Accounting Today

JUNE 5, 2024

The Internal Revenue Service is turning to artificial intelligence to help select tax returns to audit and narrow the tax gap, but it needs to use this new technology consistently and transparently, according to a new government report.

Let's personalize your content