How to reconcile an account

Accounting Tools

JULY 8, 2023

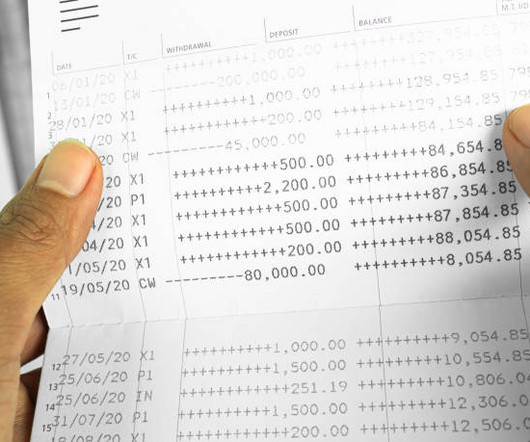

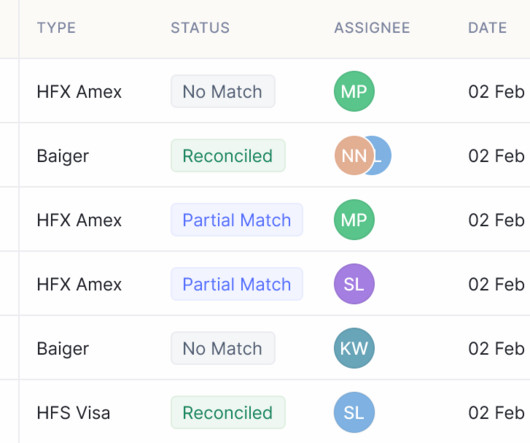

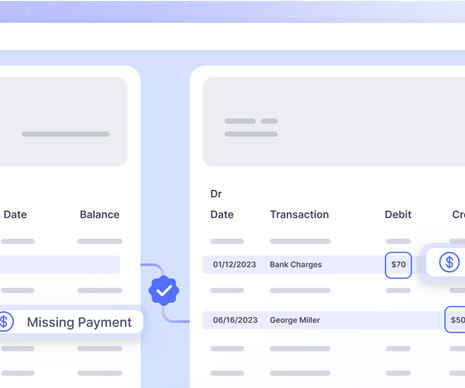

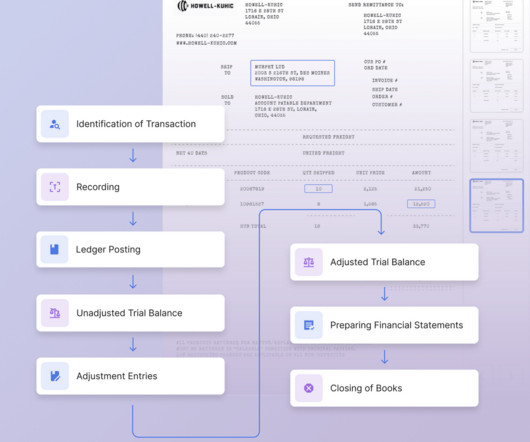

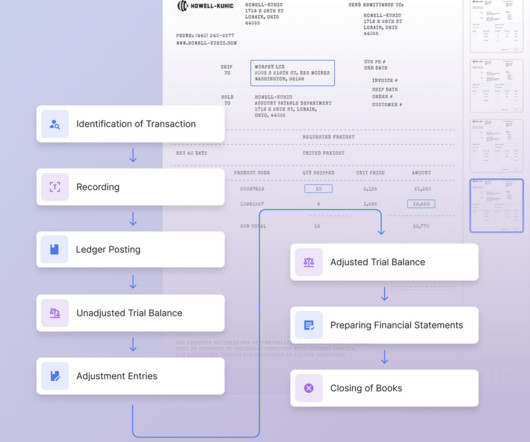

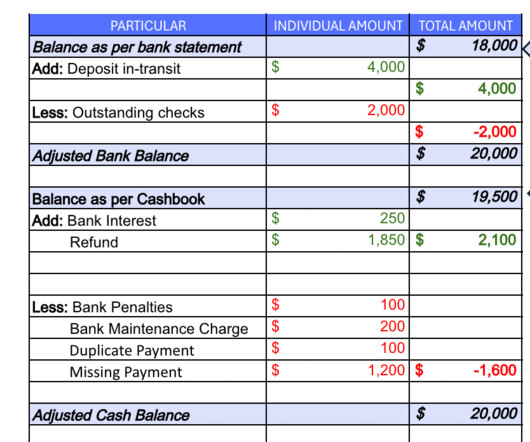

Related Courses Accountants’ Guidebook Bookkeeper Education Bundle Bookkeeping Guidebook When you reconcile an account, you are proving that the transactions that sum to the ending account balance for the account are correct. There are two ways to reconcile an account, which are noted below.

Let's personalize your content