IRS warns of summertime tax scams

Accounting Today

JULY 21, 2023

The Internal Revenue Service is seeing a surge of tax scams this summer hitting taxpayers via email and text messages touting tax refunds and quick fixes to their tax problems.

Accounting Today

JULY 21, 2023

The Internal Revenue Service is seeing a surge of tax scams this summer hitting taxpayers via email and text messages touting tax refunds and quick fixes to their tax problems.

Enterprise Recovery

JULY 21, 2023

As the SaaS industry experiences exponential growth, it is not surprising that non-payment issues have become a pressing concern. Non-payment creates cash flow challenges and hampers the ability to invest in product development, customer support, and overall business growth. It's imperative for SaaS companies to address non-payment issues proactively.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

JULY 21, 2023

With increasing demands from regulators and investors to provide some form of sustainability reporting and climate-related disclosures, companies pursuing mergers and acquisitions need to vet their potential targets more closely.

Accounting Tools

JULY 21, 2023

Related Courses Accountants’ Guidebook Bookkeeper Education Bundle Bookkeeping Guidebook What is Accounting? Accounting is the systematic recordation of the financial transactions of a business. The recordation process includes setting up a system of record keeping, tracking transactions within that system, and aggregating the resulting information into a set of financial reports.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Accounting Today

JULY 21, 2023

Plus Datarails announces FP&A Genius, touted as "ChatGPT for the CFO's office;" and other accounting technology news and updates.

Accounting Tools

JULY 21, 2023

Related Courses Accounting for Inventory Cost Accounting Fundamentals Inventory Management Many business dictionaries state that there is no difference between the terms work in process and work in progress , so it is possible to interchange the terms. However, there is a difference based on the common usage of the terms process and progress. "Process" implies that there is a manufacturing process in place where products are created under a standardized and ongoing production system.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Nanonets

JULY 21, 2023

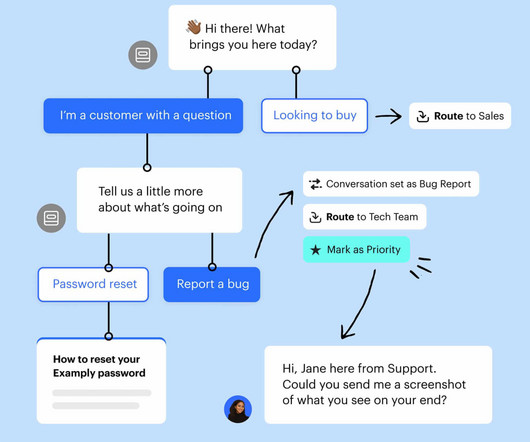

Implementing Business Process Automation (BPA) can give your employees extra hours each day. And that means more time for them to focus on core, needle-moving tasks. End result? A much more efficient, and more productive business operation. No employee should have to give up their personal time because they are spending half their workday on tedious, repetitive tasks that can be automated.

Accounting Today

JULY 21, 2023

The US Federal Reserve announced the launch of its new instant payments system, FedNow

Nanonets

JULY 21, 2023

Maintaining accurate financial records is vital for any business, and the general ledger, as the central repository of financial transactions, plays a critical role in this process. Ensuring the accuracy and integrity of the general ledger requires regular reconciliation. However, doing so manually is time-consuming and prone to error and risk. In this article, we will delve into the concept of general ledger reconciliation, its importance to businesses, and how to achieve it efficiently with th

Accounting Today

JULY 21, 2023

ChatGPT provides an opening for educators to use artificial intelligence to help address the pipeline problem.

Speaker: Robbie Bhathal, Founder & CEO, and Matthew Acalin, Head of Credit Intelligence

In today's volatile financial environment, how confident are you in your company’s financial forecasting? To get the most accurate cash predictions that will lead to long-term financial survival, real-time data is critical. Innovative cash management strategies can lead to better credit opportunities, more sustainable growth, and long-term financial prosperity.

Accounting Fun

JULY 21, 2023

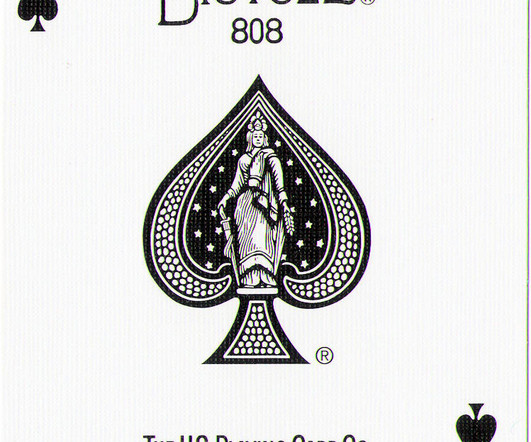

A few years ago I was researching a new talk that involves a reference to playing cards and was astonished the learn the following. Why didn't anyone ever tell me this before? When you look at the central image of a spade on the Ace of Spades it is often more ornate than that on the other aces and the reason is tax related! Apparently this all began in the 17th century under the reign of King James.

Accounting Today

JULY 21, 2023

The former head of a Thai industrial cable maker at the center of an accounting scandal and debt defaults has been flagged by local authorities seeking to arrest him.

Accounting Tools

JULY 21, 2023

Related Courses Accounting for Income Taxes What is a Carryback? A carryback is the application of a tax loss to any prior years in which a taxable profit was earned. The concept is used to earn an immediate tax refund from the Internal Revenue Service, thereby recovering taxes paid in prior years. In essence, application of the carryback has the same effect as though the company had overpaid its taxes in prior years.

Accounting Today

JULY 21, 2023

Centri Business Consulting hosts first Community Collaboration Day; Grant Thornton adds 75 partners; and more news from across the profession.

Advertisement

All accounting teams know what it is like to dread the inevitable month-end scaries. If there was a way to feel less burdened and maybe even a little enthusiastic to work on your month-end close and reconciliation process, would you do it? No, don't answer that, of course you would! Automate your month-end close process by up to 40% with SkyStem's ART and see how much more alive you feel!

Accounting Tools

JULY 21, 2023

Related Courses Business Combinations and Consolidations CPA Firm Mergers and Acquisitions Divestitures and Spin-Offs Mergers and Acquisitions What is a Vertical Merger? A vertical merger is an acquisition by an organization of a supplier or customer. Buying a supplier is called backward integration , while buying a customer is called forward integration.

Accounting Today

JULY 21, 2023

For private equity organizations crafting acquisition strategies, and for the firms they are eyeing, it's essential to understand these distinctions.

Accounting Tools

JULY 21, 2023

Related Courses Cost Accounting Fundamentals What is the Direct Material Variance? The direct material variance is the difference between the standard cost of materials resulting from production activities and the actual costs incurred. The direct material variance is comprised of two other variances, which are noted below. It is customary to calculate and report these two variances separately, so that management can determine if variances are caused by purchasing issues or manufacturing problem

NACM

JULY 21, 2023

? Check out today's episode of the Extra Credit podcast! It's all the latest commercial bankruptcy trends.? Hear from Jeff Gregory, CCE; Mike Papandrea; and Jason Torf!

Advertisement

The status quo for AP in small and mid-market companies is broken. It consists of messy tech stacks of siloed solutions that give rise to manual work, a lack of control, wasted spend, and unnecessary risks. The benefits of shifting to spend management are tangible, measurable, and are felt across the whole organization. Spend management is a different way of thinking and an innovation whose time has come.

Accounting Tools

JULY 21, 2023

Related Courses Cost Accounting Fundamentals Financial Analysis What is Variable Expense? A variable expense is a cost that alters in conjunction with some type of activity. For example, the direct materials expense increases as sales increase. Other variable expenses are commissions , billable labor, piece rate labor, and credit card fees. A business has few truly variable expenses.

Nanonets

JULY 21, 2023

The accuracy and reliability of financial reporting are vital for organizations to make informed decisions and meet regulatory requirements. To ensure the integrity of financial data, accountants and bookkeepers rely on the general ledger account reconciliation process. This process involves comparing general ledger accounts with supporting documents using reconciliation software to identify discrepancies and take corrective measures.

Accounting Tools

JULY 21, 2023

Related Courses Quality Management Fundamentals What are Preventive Costs? Preventive costs are any expenditures incurred that are intended to minimize the number of defects in products and services. For example, a company could invest in training programs for the operators of its production machinery, to ensure that they understand how to manufacture parts correctly.

Accounting Today

JULY 21, 2023

The legislation would make clear when and how crypto firms should register with the SEC or the CFTC, which would gain new powers to directly oversee trading in certain tokens.

Speaker: Carolina Aponte - Owner and CEO, Caja Holdings LLC

In today's rapidly changing business environment, building a resilient balance sheet is crucial to the survival of any business. A resilient balance sheet allows a company to withstand financial shocks and adapt to changing market conditions. To achieve this, companies need to focus on key strategies such as maintaining adequate liquidity, managing debt levels, diversifying revenue streams, and prioritizing profitability over growth.

Accounting Tools

JULY 21, 2023

Related Courses Essentials of Employment Law Human Resources Guidebook Payroll Management What is an Employer? An employer is an organization or individual that pays individuals for work performed under a contract of employment. Because of this arrangement, the employer has a legal obligation to withhold payroll taxes and income taxes from employee pay, and remit these funds to the applicable government.

Accounting Tools

JULY 21, 2023

Related Courses Fair Value Accounting What is Value-in-Use? Value-in-use is the net present value of the cash flows generated by an asset as it is currently being used by the owner. This amount may be less than the net present value of cash flows from the highest and best use to which an asset can be put. For example, the value-in-use of farmland in an urban area could be much lower than its highest and best use, since the farmer could earn more by constructing commercial or residential building

Accounting Tools

JULY 21, 2023

Related Courses Business Ratios Guidebook Financial Analysis The Interpretation of Financial Statements What is Segment Margin? Segment margin is the amount of net profit or net loss generated by a portion of a business. It is useful to track segment margins (especially on a trend line ) in order to learn which parts of a business are performing better or worse than average.

Accounting Tools

JULY 21, 2023

Related Courses Accounting for Retirement Benefits What is a Vested Benefit Obligation? A vested benefit obligation is the actuarial present value of benefits that have been earned by employees. This obligation is typically associated with multi-year cliff vesting requirements for employees, so a firm whose employees have a relatively high level of seniority will have a larger vested benefit obligation than a firm with newer employees.

Speaker: Wayne Spivak, President and CFO of SBA * Consulting Ltd., Industry Writer, Public Speaker

If you’re lost in the world of spend management needs and your GAP analysis is lacking perspective on the future state of your business performance, listen up! With the advancement of technology, the implementation of spend management best practices and concrete GAP analyses is more streamlined and accessible than ever before. And while this may sound like great news for you and your clients, it won’t be worthwhile unless you have the latest techniques to back up your ambitions!

Accounting Tools

JULY 21, 2023

Related Courses Activity-Based Management Lean Accounting Guidebook Project Management What is a Value-Added Activity? A value-added activity is any action taken that increases the benefit of a good or service to a customer. A business can vastly increase its profitability by recognizing which activities increase value and which do not, and stripping away the non value-added activities.

Accounting Tools

JULY 21, 2023

Related Courses Business Ratios Guidebook Capital Budgeting The Interpretation of Financial Statements What is the Return on Invested Capital? The return on invested capital compares a firm’s return on capital to its cost of capital. If the comparison yields a positive number that exceeds the current inflation rate, this means that the firm is doing a good job of allocating its funds to projects that yield a reasonable return.

Accounting Tools

JULY 21, 2023

Related Courses Cost Accounting Guidebook Financial Analysis What is the Variable Cost Ratio? The variable cost ratio reveals the total amount of variable expenses incurred by a business, stated as a proportion of its net sales. For example, if the price of a product is $100 and its variable expenses are $60, then the product's variable cost ratio is 60%.

Accounting Tools

JULY 21, 2023

Related Courses Activity-Based Management Constraint Management Lean Accounting Guidebook What is Value Analysis? Value analysis is a systematic review of the production, purchasing and product design processes to reduce overall product costs. This can be accomplished through a variety of activities, including the following: Designing products to use lower-tolerance parts that are less expensive Switching to lower-cost components Standardizing parts across product platforms in order to achieve v

Advertisement

Developing a consistent month-end close doesn’t need to be a mystery. We’re sharing our top 10 secrets (plus one bonus!) for streamlining your close.

Let's personalize your content