On the move: Sax hires first CIO

Accounting Today

APRIL 12, 2024

CohnReznick launches new digital advisory practice; Kruze Consulting and KPMG separately release CEO reports; and more news from across the profession.

Accounting Today

APRIL 12, 2024

CohnReznick launches new digital advisory practice; Kruze Consulting and KPMG separately release CEO reports; and more news from across the profession.

FinOps Foundation

APRIL 12, 2024

Key Insight: FinOps success results from getting FinOps practitioners, product teams, and engineers to think cost-first with architectural decisions, and that starts with clean, reliable data. One of Tim’s biggest challenges is bringing so much data together for analysis. Walmart built a data lake where they store several years of raw data in object storage so they can go back and re-parse it in different ways.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

APRIL 12, 2024

Plus, DataSnipper releases new suites for cloud collaboration, data extraction; and other accounting tech updates.

CSI Accounting & Payroll

APRIL 12, 2024

When you need a payroll service for your small business, it’s usually because running payroll has started taking up too much of your time or your business has developed some unique payroll needs. Maybe you need a way for your employees to clock in and out of work, or maybe you need help with certain types of garnishments from an employee’s check. Regardless, you’ll want to know a payroll service’s capabilities before coming on board.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Accounting Today

APRIL 12, 2024

The Internal Revenue Service is getting ready for an onslaught of tax returns arriving by Tax Day on Monday, though many taxpayers will be eligible for automatic extensions due to natural disasters across the country.

Invoicera

APRIL 12, 2024

Think about this: You are an accountant! You are back in the office, ready to start your job day! What do you see? You haven’t received payments for the invoices you generated! And what you see is a list of excuses for not getting timely payments. It’s not the first day of this happening, it occurs many times. Overdue invoices are frustrating as it affects cash flow of a business.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Nanonets

APRIL 12, 2024

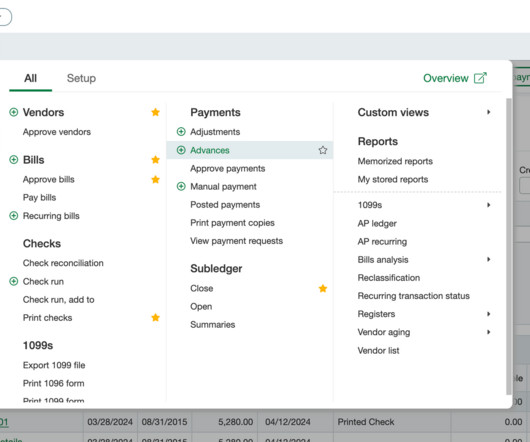

Invoices are a time-consuming hassle but a part of every business. Sage Intacct makes the entire process simple. It creates professional invoices for your accounts receivables and helps process invoices as part of your accounts payables. Sage Intacct has additional features to simplify both ends of invoices. With tracking and reporting, supporting recurring invoices, and recording payments, these extra features make Sage Intacct's capabilities one of the best.

Accounting Today

APRIL 12, 2024

The IRS threw a late curveball at tax professionals scrambling to meet the April 15 deadline.

Nanonets

APRIL 12, 2024

The Importance of Accounts Reconciliation Companies handle a variety of finance-related documents, ranging from bank statements to invoices and payroll records. Amidst this deluge of numbers and figures lies a crucial task: account reconciliation. Without accurate reconciliation, discrepancies can slip through unnoticed, leading to financial inaccuracies, compliance issues, and potential for fraud.

Accounting Today

APRIL 12, 2024

Use your expertise and knowledge to help guide your clients to create growing and more profitable businesses.

Speaker: Robbie Bhathal, Founder & CEO, and Matthew Acalin, Head of Credit Intelligence

In today's volatile financial environment, how confident are you in your company’s financial forecasting? To get the most accurate cash predictions that will lead to long-term financial survival, real-time data is critical. Innovative cash management strategies can lead to better credit opportunities, more sustainable growth, and long-term financial prosperity.

Nanonets

APRIL 12, 2024

Bank Reconciliation Vs. Book Reconciliation In accounting and financial management, we encounter the terms "Book Reconciliation" and " Bank Reconciliation " These terms are often used interchangeably, leading to ambiguity regarding their meanings. Book Reconciliation serves as the umbrella term, encompassing a broader spectrum of financial data matching that involves comparing the ledger entries with figures from other financial documents.

Accounting Today

APRIL 12, 2024

The alleged bookmaker is under criminal investigation by the IRS as well.

Economize

APRIL 12, 2024

Understanding AWS Data Transfer Costs AWS offers a vast array of services, offering scalability and flexibility to cater to your business needs. However, the costs associated with data transfer within these cloud services are a hidden aspect, significantly impacting your cloud bill.

Accounting Fun

APRIL 12, 2024

The expression "Morton's Fork" originates from a policy of tax collection. It was devised by John Morton, who was Lord Chancellor of England in 1487, under the rule of King Henry VII. Morton's approach was that if the subject lived in luxury and had clearly spent a lot of money on himself, he obviously had sufficient income to spare for the king. Alternatively, if the subject lived frugally, and showed no sign of being wealthy, he must have substantial savings and could therefore afford to give

Advertisement

All accounting teams know what it is like to dread the inevitable month-end scaries. If there was a way to feel less burdened and maybe even a little enthusiastic to work on your month-end close and reconciliation process, would you do it? No, don't answer that, of course you would! Automate your month-end close process by up to 40% with SkyStem's ART and see how much more alive you feel!

Ace Cloud Hosting

APRIL 12, 2024

TaxWise Desktop is an all-in-one tax preparation software that helps firms file and manage U.S. tax returns with ease. With TaxWise, you can prepare both individual and business tax returns.

Accounting Tools

APRIL 12, 2024

What is an Allowance in Accounting? An allowance is a reserve that is set aside in the expectation of expenses that will be incurred at a future date. The creation of a reserve essentially accelerates the recognition of an expense into the current period from the later period in which it would otherwise have been recognized. The intent of a reserve is to match expenses with the sales transactions with which they are associated.

Accounting Tools

APRIL 12, 2024

What is a Discount Rate in Finance? A discount rate is the interest rate used to discount a stream of future cash flows to their present value. Depending upon the application, typical rates used as the discount rate are a firm's cost of capital or the current market rate. Management might also add a risk premium to a company’s cost of capital when it is evaluating the cash flows from an especially risky investment, in order to reduce the present value of its expected cash flows.

Accounting Tools

APRIL 12, 2024

What is a Dividend? A dividend is a payment made to shareholders that is proportional to the number of shares owned. It is authorized by the board of directors. Many larger publicly-held companies issue dividends on an annual or quarterly basis to their shareholders. Why are Dividends Paid? Dividends are usually issued by companies that will not reap significant growth by reinvesting profits , and so instead choose to return funds to shareholders in the form of a dividend.

Advertisement

The status quo for AP in small and mid-market companies is broken. It consists of messy tech stacks of siloed solutions that give rise to manual work, a lack of control, wasted spend, and unnecessary risks. The benefits of shifting to spend management are tangible, measurable, and are felt across the whole organization. Spend management is a different way of thinking and an innovation whose time has come.

Accounting Tools

APRIL 12, 2024

What is a Requisition? A requisition is a written request made by an employee for an organization's purchasing department to buy goods or services. This request specifies the exact item and quantity to be obtained, so that the purchasing staff can more efficiently source what is needed. A requisition form may be signed by the department manager whose department will be charged for the purchase; doing so gives the manager approval authority over every purchase.

Accounting Tools

APRIL 12, 2024

What is a Rebate? A rebate is a payment back to a buyer of a portion of the full purchase price of a good or service. This payment is typically triggered by the cumulative amount of purchases made within a certain period of time. Rebates are generally designed to increase the volume of purchases made by customers. Example of a Rebate As an example of a rebate, a seller offers a 10% volume discount to a buyer if the buyer purchases at least 10,000 units within one year.

Accounting Tools

APRIL 12, 2024

What is a Rollover? A rollover involves the transfer of funds from one investment to another. These transactions usually involve the transfer of funds between similar investment vehicles, though a treasury department may shift funds into investments with different maturities , depending on when the cash is expected to be needed. Rollovers are especially useful when shifting funds between retirement accounts, since rollover transactions do not trigger taxable events.

Accounting Tools

APRIL 12, 2024

What is a Recognized Gain? A recognized gain occurs when an asset is sold for an amount greater than its purchase price. It is calculated as the sale price of an asset, minus the purchase cost of the asset. This situation most commonly arises when an entity sells either a security or property. Depending on the nature of the asset and the circumstances of the sale , a recognized gain may qualify for capital gains treatment, which means that the income tax rate paid is significantly reduced.

Speaker: Carolina Aponte - Owner and CEO, Caja Holdings LLC

In today's rapidly changing business environment, building a resilient balance sheet is crucial to the survival of any business. A resilient balance sheet allows a company to withstand financial shocks and adapt to changing market conditions. To achieve this, companies need to focus on key strategies such as maintaining adequate liquidity, managing debt levels, diversifying revenue streams, and prioritizing profitability over growth.

Accounting Tools

APRIL 12, 2024

What is a Recognized Loss? A recognized loss occurs when an asset is sold for an amount less than its purchase price. This situation most commonly arises when an entity sells either a security or property. Depending on the nature of the asset and the circumstances of the sale , a recognized loss may qualify for capital gains treatment, which means that the loss can be deducted from any capital gains reported for tax purposes.

Accounting Tools

APRIL 12, 2024

What is a Reconciliation in Accounting? A reconciliation involves matching two sets of records to see if there are any differences. Reconciliations are a useful step in ensuring that accounting records are accurate. If a difference is found during a reconciliation, it may be caused by a timing issue, where documentation has been recorded in one of the accounting records, but not the other.

Accounting Tools

APRIL 12, 2024

What is a Restricted Fund? A restricted fund is used by a nonprofit entity to store funds that have a limited use, as per the requirements of donors. An example of a restricted fund is an endowment, where the principal is only to be used to generate investment income, and the uses to which the income can be put may also be restricted. Advantages of a Restricted Fund Restricted funds are preferred by many donors, since they can be used to ensure that donations are directed as desired by the donor

Accounting Tools

APRIL 12, 2024

What is Depreciation Basis? Depreciation basis is the amount of a fixed asset's cost that can be depreciated over time. This amount is the acquisition cost of an asset, minus its estimated salvage value at the end of its useful life. Acquisition cost is the purchase price of an asset, plus the cost incurred to put the asset into service. Thus, the acquisition cost can include sales taxes , customs duties, freight charges, on-site modifications (such as wiring or a concrete pad for the asset), in

Speaker: Wayne Spivak, President and CFO of SBA * Consulting Ltd., Industry Writer, Public Speaker

If you’re lost in the world of spend management needs and your GAP analysis is lacking perspective on the future state of your business performance, listen up! With the advancement of technology, the implementation of spend management best practices and concrete GAP analyses is more streamlined and accessible than ever before. And while this may sound like great news for you and your clients, it won’t be worthwhile unless you have the latest techniques to back up your ambitions!

Accounting Tools

APRIL 12, 2024

What is a Duplicate Payment? A duplicate payment is an additional payment made to a supplier that has already been paid. When these additional payments are for smaller amounts, they may be difficult to detect, resulting in a permanent increase in your expenses and a related cash outflow. A duplicate payment for a larger amount is generally relatively easy to spot, but can require a substantial amount of work to retrieve from the recipient.

Accounting Tools

APRIL 12, 2024

What is Diversifiable Risk? Diversifiable risk is the possibility that there will be a change in the price of a security because of the specific characteristics of that security. Diversification of an investor’s portfolio can be used to offset and therefore eliminate this type of risk. Diversifiable risk differs from the risk inherent in the marketplace as a whole.

Accounting Tools

APRIL 12, 2024

What is a Transparent Market? A transparent market arises when market participants have full access to pricing information. In this environment, assets and liabilities are priced better, since buyers and sellers have full knowledge about transactions. The rules governing financial reporting are intended to encourage transparent markets. This is especially the case when securities are being publicly traded, since the Securities and Exchange Commission requires a high level of financial detail fro

Accounting Tools

APRIL 12, 2024

What is a Reporting Currency? A reporting currency is the currency in which a parent organization prepares its financial statements. The reporting currency is usually the currency used in an organization's home country. In order to issue financial statements in its reporting currency, a multi-national firm must first convert the reporting of its subsidiaries in other countries to the reporting currency.

Advertisement

Developing a consistent month-end close doesn’t need to be a mystery. We’re sharing our top 10 secrets (plus one bonus!) for streamlining your close.

Let's personalize your content