IRS inaugurates Tax Professional Awareness Week

Accounting Today

JANUARY 5, 2024

The Internal Revenue Service will be hosting a Tax Professional Awareness Week starting Monday, Jan. 8, to give tax pros an opportunity to get ready for tax season.

Accounting Today

JANUARY 5, 2024

The Internal Revenue Service will be hosting a Tax Professional Awareness Week starting Monday, Jan. 8, to give tax pros an opportunity to get ready for tax season.

FinOps Foundation

JANUARY 5, 2024

Video Overview This is a paragraph: Lorem ipsum dolor sit amet consectetur. Commodo est sed justo risus enim. Amet eleifend cum maecenas faucibus elit at orci. Ullamcorper suscipit enim parturient velit pharetra lacus. Non at semper lorem sit. Aenean pretium velit amet id massa cras tincidunt id. Netus scelerisque feugiat placerat nullam congue commodo.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

JANUARY 5, 2024

Businesses eager to see Congress revive expired research and investment tax breaks have reason for optimism that a deal could come together as soon as this month.

SMB Accounting and Consulting

JANUARY 5, 2024

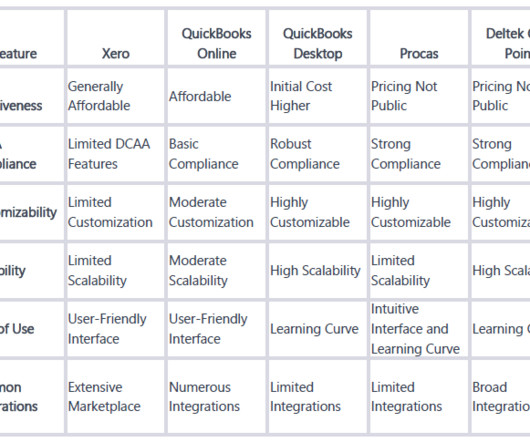

Beyond the mere transition in dates, New Year's marks a universal opportunity for change. It can serve as a catalyst for reflection, inspiring individuals to set resolutions, for themselves and their businesses. The beginning of a new year also means a fresh start for your Income Statement; which is why now is the perfect time to review your accounting software needs.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Accounting Today

JANUARY 5, 2024

The Internal Revenue Service is extending the period for dealers and sellers of so-called "clean" vehicles such as electric cars to submit time-of-sale reports by a few days to qualify for tax credits.

Cloud Accounting Podcast

JANUARY 5, 2024

In this 2023 wrap-up, Blake and David discuss an appeals court ruling that audit reports are so generic they are essentially useless to investors. They also explore the concept of "productivity theater" where employees pretend to be constantly working, even though it leads to disengagement and burnout. Continuing the theme, they contemplate why mandatory weekend work persists and share ideas on how firms can improve work-life balance.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Invoicera

JANUARY 5, 2024

Introduction Do you also get confused when handling multiple projects and billing simultaneously? It’s not just you. Combining billing with project management is a wise decision, but demands careful planning for a successful business journey. According to a survey by the Project Management Institute, organizations waste an average of $122 million for every $1 billion invested due to poor project performance.

Accounting Today

JANUARY 5, 2024

Brown Schultz Sheridan & Fritz assumes new name of Brown Plus; FASB appoints six to Not-for-Profit Advisory Committee; and more news from around the profession.

Nanonets

JANUARY 5, 2024

Transformative technologies such as enterprise resource planning (ERP), customer relationship management (CRM), and supply chain management (SCM) systems have brought productivity breakthroughs that have dramatically improved business performance. The finance function has reaped benefits from these advances but there’s much more to come. The next wave of transformation is upon us, and it involves transactions between business partners.

Accounting Today

JANUARY 5, 2024

CPA firms play a pivotal role in supporting small businesses as they embark on the challenging path of international expansion.

Speaker: Robbie Bhathal, Founder & CEO, and Matthew Acalin, Head of Credit Intelligence

In today's volatile financial environment, how confident are you in your company’s financial forecasting? To get the most accurate cash predictions that will lead to long-term financial survival, real-time data is critical. Innovative cash management strategies can lead to better credit opportunities, more sustainable growth, and long-term financial prosperity.

Accounting Fun

JANUARY 5, 2024

A punny accountant was describing some of his clients: I assisted a bakery recently; they needed help with their financial dough-cuments. Ensured their profits were well-kneaded, proving accountancy isn't just a piece of cake. Dealing with a fitness centre was taxing, but I managed to balance their accounts without breaking a sweat. It seems crunches aren't the only thing that requires precision!

Accounting Today

JANUARY 5, 2024

The Regional Leader merged in a firm in Winter Park, Florida.

Accounting Tools

JANUARY 5, 2024

What is Vacation Pay Expense? Vacation pay expense is a general ledger account in which is recorded the amount of vacation pay earned by employees. The amount in the account is updated at the end of each reporting period to reflect the additional expense generated as a result of employee time worked during the period. Presentation of Vacation Pay Expense Vacation pay expense is quite a small part of the overall compensation expense recorded by a business, so it usually does not appear in a separ

LedgerDocs

JANUARY 5, 2024

Budget Like a Pro: Revisiting and fine tuning of a business’s budgets are important and should be done regularly. Make it a goal to revisit these monthly or quarterly to stay on top of the businesses progress towards financial targets and help them identify areas for cost-cutting, and advice on allocating resources efficiently. Embrace Technology: A good way to up your clients financial game is suggesting adopting the latest accounting software and financial technology tools.

Advertisement

All accounting teams know what it is like to dread the inevitable month-end scaries. If there was a way to feel less burdened and maybe even a little enthusiastic to work on your month-end close and reconciliation process, would you do it? No, don't answer that, of course you would! Automate your month-end close process by up to 40% with SkyStem's ART and see how much more alive you feel!

Accounting Tools

JANUARY 5, 2024

What is the Accounting Equation? The accounting equation shows the relationship between assets , liabilities and equity. It is the basis upon which the double entry accounting system is constructed. Business transactions must be recorded in accordance with the accounting equation, to ensure that each part of a journal entry is correct. In essence, the accounting equation is as follows: Assets = Liabilities + Shareholders' Equity The asset, liability, and shareholders’ equity portions of the acco

Accounting Today

JANUARY 5, 2024

The debt ceiling agreement included a side deal that would allow $70 billion in accounting moves to spare agencies most cuts, though $20 billion in cuts to IRS funds may be accelerated.

Accounting Tools

JANUARY 5, 2024

What is a Collection Period? A collection period is the average number of days required to collect receivables from customers. It is measured as the interval from the issuance of an invoice to the receipt of cash from the customer. It is commonly tracked as a measure of the credit and collection efficiency of a business. A shorter collection period is considered optimal, since the creditor entity has its funds at risk for a shorter period of time, and also needs less working capital to run the b

Let's personalize your content