Intuit Reports Strong Fourth Quarter and Full Year Results

Insightful Accountant

SEPTEMBER 3, 2023

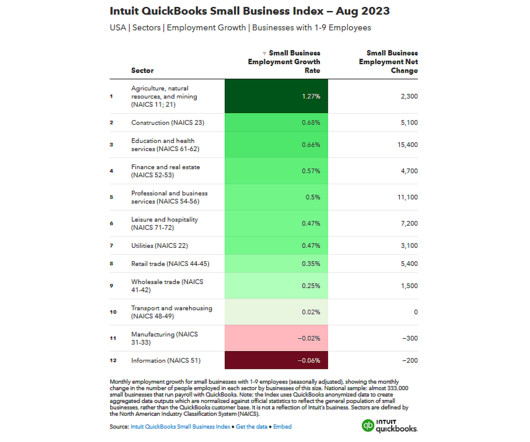

Intuit had a very strong fourth quarter, ending the year with momentum by growing total revenue to $14.4-billion, up 13% year-over-year. Their Small Business & Self-Employed Group revenue grew 24%.

Let's personalize your content