Number of accounting grads plummets further

Accounting Today

OCTOBER 12, 2023

The number of students earning accounting degrees keeps falling, according to the latest figures released by the American Institute of CPAs.

Accounting Today

OCTOBER 12, 2023

The number of students earning accounting degrees keeps falling, according to the latest figures released by the American Institute of CPAs.

Fidesic blog

OCTOBER 12, 2023

Whether you’re talking about your COO, CFO, CIO or the entire executive suite, these folks are probably juggling a lot of moving parts. If they are hesitant to invest or even spend time discussing AP automation, it’s probably because they are dedicating their busy calendar time to what they see as more important and more exciting.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

OCTOBER 12, 2023

Monthly checks for the more than 71 million people receiving retirement or disability benefits in the U.S. will get a 3.2% increase next year, the smallest gain since 2021, reflecting a significant cooling in the rate of inflation.

Accounting Department

OCTOBER 12, 2023

Inventory management is crucial for any business, regardless of its size or industry. But, as a business owner, you may wonder how often you should perform a thorough inventory check.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Accounting Today

OCTOBER 12, 2023

In a dramatic reversal, just weeks before the 92-year-old was due to stand trial, Bernie Ecclestone agreed to a £652 million tax settlement that covers an 18-year period.

Insightful Accountant

OCTOBER 12, 2023

Digitization of accounts payable tops finance leaders’ priorities for third consecutive year in MineralTree’s annual 'State of AP Report.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Accounting Tools

OCTOBER 12, 2023

Related Courses Credit and Collection Guidebook Effective Collections What is Credit Risk? Credit risk is the risk of loss due to a borrower not repaying a loan. More specifically, it refers to a lender’s risk of having its cash flows interrupted when a borrower does not pay principal or interest to it. Credit risk is considered to be higher when the borrower does not have sufficient cash flows to pay the creditor , or it does not have sufficient assets to liquidate make a payment.

Accounting Today

OCTOBER 12, 2023

The service updated its tax-gap projections for tax years 2020 and 2021, predicting a big jump from prior estimates.

Accounting Tools

OCTOBER 12, 2023

Related Courses Bookkeeping Guidebook Credit and Collection Guidebook How to Audit Receivables What is a Bad Debt? A bad debt is a receivable that a customer will not pay. Bad debts are possible whenever credit is extended to customers. They arise when a company extends too much credit to a customer that is incapable of paying back the debt , resulting in either a delayed, reduced, or missing payment.

Accounting Today

OCTOBER 12, 2023

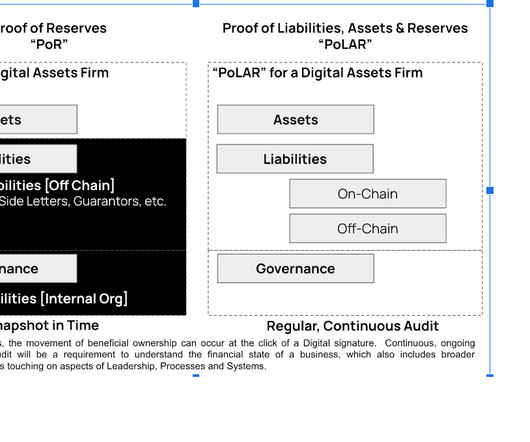

Since crypto's meltdown in 2022 the digital asset industry has come to rely on "proof of reserves" as the go-to attestation, from an internal accounting and market reassurance perspective.

Speaker: Robbie Bhathal, Founder & CEO, and Matthew Acalin, Head of Credit Intelligence

In today's volatile financial environment, how confident are you in your company’s financial forecasting? To get the most accurate cash predictions that will lead to long-term financial survival, real-time data is critical. Innovative cash management strategies can lead to better credit opportunities, more sustainable growth, and long-term financial prosperity.

Insightful Accountant

OCTOBER 12, 2023

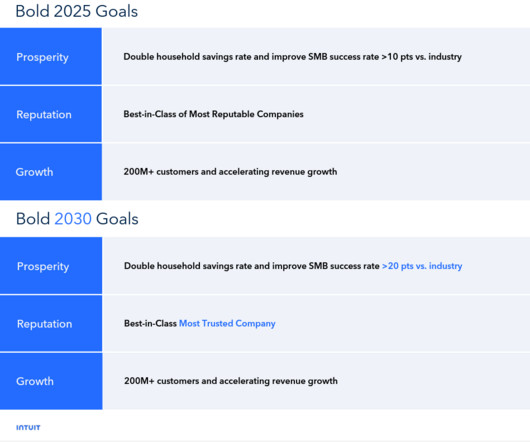

Take a look at Intuit's bold goals, new strategy and five big bets for the company's future.

Accounting Today

OCTOBER 12, 2023

No temporary solution; cooking some books; French connection; and other highlights of recent tax cases.

Jetpack Workflow

OCTOBER 12, 2023

Podcast Summary In this episode of “Growing Your Firm,” host David Cristello interviews David Leary, partner at Earmark Media and co-host of The Accounting Podcast. They discuss David Leary’s experience of being fired as a client from an accounting firm and how it led him to become a business owner and customer of accounting firms. They also touch on the talent shortage in the industry and the quality of TurboTax Live.

Accounting Today

OCTOBER 12, 2023

"These findings are damning," Jon Holt, chief executive officer of KPMG in the U.K., said. "It is clear to me that our audit work on Carillion was very bad, over an extended period.

Advertisement

All accounting teams know what it is like to dread the inevitable month-end scaries. If there was a way to feel less burdened and maybe even a little enthusiastic to work on your month-end close and reconciliation process, would you do it? No, don't answer that, of course you would! Automate your month-end close process by up to 40% with SkyStem's ART and see how much more alive you feel!

Tipalti

OCTOBER 12, 2023

Payment processors also work as intermediaries to process other payment methods. These payment options include ACH bank transfer and eCheck. E-check is a broad term for electronic checks used for ACH and global payments made through a payment processor.

Accounting Today

OCTOBER 12, 2023

The dispute centers on a 2012 IRS audit into transfer pricing, a method used by companies to shift profits to tax havens and avoid the U.S. corporate tax rate.

Nanonets

OCTOBER 12, 2023

The problem of manual sales order processing The sales order processing workflow is integral to the overall order to cash process. In most medium to large B2B businesses sales orders are still entered/created manually by internal sales reps. This is the case even for large organisations that use SAP as their system of record (ERP) and process large volumes of orders.

Accounting Today

OCTOBER 12, 2023

CohnReznick acquired Exiger's public sector advisory group; DJH Mitten Clarke acquired Revell Ward, Lyon Griffiths, and Haines Watts' Altrincham office; and OD Accountants acquired Probusiness.

Advertisement

The status quo for AP in small and mid-market companies is broken. It consists of messy tech stacks of siloed solutions that give rise to manual work, a lack of control, wasted spend, and unnecessary risks. The benefits of shifting to spend management are tangible, measurable, and are felt across the whole organization. Spend management is a different way of thinking and an innovation whose time has come.

Tipalti

OCTOBER 12, 2023

Which alternatives rival ZipHQ when it comes to procurement automation and business spend control solutions? Read our comprehensive breakdown of top ZipHQ competitors.

Accounting Today

OCTOBER 12, 2023

The Task force on Climate-related Financial Disclosures is seeing more than half of companies issuing at least a handful of the disclosures it recommends.

Tipalti

OCTOBER 12, 2023

The supplier payment process involves tax compliance, fraud monitoring, currency exchange rates, banking requirements, and more. If your supplier payment process can’t nimbly respond to these factors, you’ll have to manually adjust to each vendor’s situation.

Accounting Today

OCTOBER 12, 2023

Hanno Berger was convicted in a tax scandal that robbed billions of euros from government coffers and ensnared some of Wall Street's biggest banks.

Speaker: Carolina Aponte - Owner and CEO, Caja Holdings LLC

In today's rapidly changing business environment, building a resilient balance sheet is crucial to the survival of any business. A resilient balance sheet allows a company to withstand financial shocks and adapt to changing market conditions. To achieve this, companies need to focus on key strategies such as maintaining adequate liquidity, managing debt levels, diversifying revenue streams, and prioritizing profitability over growth.

Accounting Tools

OCTOBER 12, 2023

Related Courses Bookkeeper Education Bundle Bookkeeping Guidebook What is Systematic Expensing? Systematic expensing is the charging of an asset to expense over a period of time, using a consistently-applied methodology. This approach is commonly used for depreciation and amortization , where a straight-line, accelerated, or usage-based expensing approach is applied.

Accounting Today

OCTOBER 12, 2023

The best and most differentiated firms prioritize leveraging technology to increase their clients' efficiency.

Accounting Tools

OCTOBER 12, 2023

Related Courses Credit & Collection Guidebook Effective Collections How to Audit Receivables What is a Billing Statement? A billing statement is a listing of the transactions impacting an account during a specific period of time. Statements are typically sent to customers on a monthly basis, so that they can review and verify account activity. The format of a statement that relates to unpaid customer receivables usually contains a reminder to pay any unpaid amounts that have exceeded the pay

Accounting Today

OCTOBER 12, 2023

The White House Council of Economic Advisers said a reduction in revenues from capital gains taxes has played a notable role in the widening deficit.

Speaker: Wayne Spivak, President and CFO of SBA * Consulting Ltd., Industry Writer, Public Speaker

If you’re lost in the world of spend management needs and your GAP analysis is lacking perspective on the future state of your business performance, listen up! With the advancement of technology, the implementation of spend management best practices and concrete GAP analyses is more streamlined and accessible than ever before. And while this may sound like great news for you and your clients, it won’t be worthwhile unless you have the latest techniques to back up your ambitions!

Accounting Tools

OCTOBER 12, 2023

What is a Single Entity? A single entity is an operating unit for which financial information is reported. A single entity may be a separate legal entity, a subsidiary , department , or any other designation – as long as information is collected specifically for it, and decisions are made based on that information. For example, the CEO of a conglomerate requests that a single entity report be generated that shows the financial performance of its North American subsidiary.

Accounting Tools

OCTOBER 12, 2023

A sales account contains the record of all sales transactions. This includes both cash sales and credit sales. The account total is then paired with the sales returns and allowances account to derive the net sales figure that is listed at the top of the income statement. The sales account concept can also refer to a current customer. Once sales are made to a customer, it is known as a sales account.

Accounting Tools

OCTOBER 12, 2023

Related Courses Bookkeeper Education Bundle Bookkeeping Guidebook What is a Simple Journal Entry? A simple journal entry is an accounting entry in which just one account is debited and one is credited. The use of simple journal entries is encouraged as a best practice, since it is easier to understand these entries. The best possible approach to their use is to thoroughly document the reasons for each entry, and store this backup information along with a copy of the entry.

Accounting Tools

OCTOBER 12, 2023

Related Courses Corporate Cash Management Corporate Finance Treasurer's Guidebook What is a Secured Loan? A secured loan is a lending agreement in which the borrower pledges an asset as collateral , which the lender can seize if the borrower cannot pay back the underlying loan. Advantages of a Secured Loan A secured loan protects the interests of the lender in situations where there is uncertainty regarding the ability of the borrower to pay back a loan.

Advertisement

Developing a consistent month-end close doesn’t need to be a mystery. We’re sharing our top 10 secrets (plus one bonus!) for streamlining your close.

Let's personalize your content