The Benefits of Outsourcing for E-commerce Businesses

Accounting Department

JUNE 6, 2023

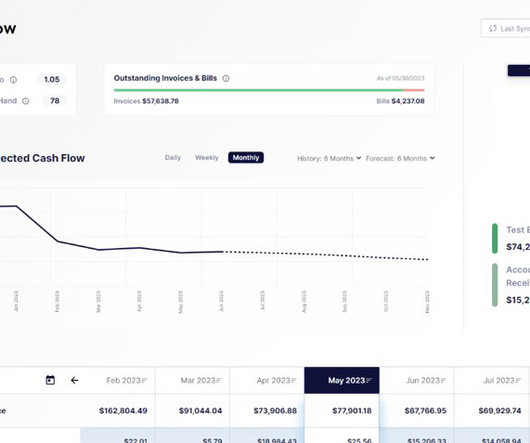

Simplifying e-commerce business operations can be achieved by outsourcing specific functions such as accounting and bookkeeping services. For an e-commerce business to thrive and succeed, it is crucial to maintain a clear understanding of its financial position, performance, profit margins, marketing commitments, stock levels, and cash flows on a regular basis.

Let's personalize your content