Bookco Ensures Data Loss Isn’t a Number's Game

Insightful Accountant

APRIL 23, 2023

How Rewind helped this Canadian bookkeeping team put their clients at ease when transitioning from an on-premises accounting solution to cloud-based software.

Insightful Accountant

APRIL 23, 2023

How Rewind helped this Canadian bookkeeping team put their clients at ease when transitioning from an on-premises accounting solution to cloud-based software.

Accounting Tools

APRIL 23, 2023

Related Courses The Balance Sheet The Income Statement The Statement of Cash Flows What are the Four Basic Financial Statements? A complete set of financial statements is used to give readers an overview of the financial results and condition of a business. The financial statements are comprised of four basic reports, which are noted below. Income Statement The income statement presents the revenues, expenses, and profits/losses generated during the reporting period.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

IMA's Count Me

APRIL 23, 2023

Dive into the world of ESG (environmental, social, and governance) at IBM with our latest episode of Count Me In. Today we discuss the challenges and successes of implementing ESG objectives in a global corporation. John our Guest John Mahoney, ESG External Reporting Project Manager and hear how IBM's commitment to sustainability, open communication, and cross-functional collaboration is driving positive change and shaping the future.

Accounting Tools

APRIL 23, 2023

Related Courses Bookkeeping Guidebook New Controller Guidebook What is Discount Allowed and Discount Received? A discount allowed is when the seller of goods or services grants a payment discount to a buyer. This discount is frequently an early payment discount on credit sales , but it can also be for other reasons, such as a discount for paying cash up front, or for buying in high volume, or for buying during a promotion period when goods or services are offered at a reduced price.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Insightful Accountant

APRIL 23, 2023

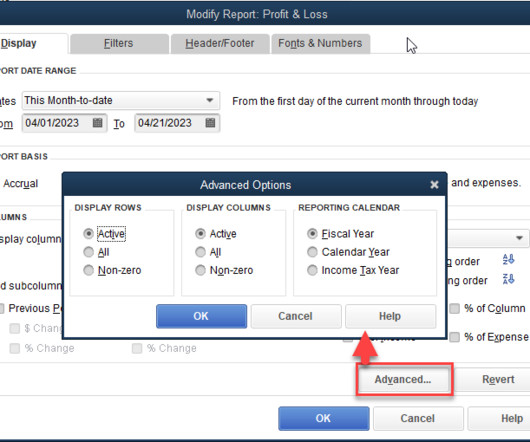

How many times do we, as ProAdvisors, forget to teach this essential part of QuickBooks Desktop Reporting to our clients? They wind up thinking QB cannot provide the clean, clear reports they want—yet it can.

Accounting Tools

APRIL 23, 2023

Related Courses Accounting for Intangible Assets Intangible Asset Valuation What are Intangible Assets? Intangible assets are assets that have no physical substance. Organizations that have invested large sums to establish brands may find that the value of their intangible assets greatly exceeds the value of their physical assets. An organization usually also has a large number of tangible assets , such as buildings, land, and machinery.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Accounting Tools

APRIL 23, 2023

Related Courses Activity-Based Costing Activity-Based Management What is a Surrogate Activity Driver? A surrogate activity driver is a driver that is closely correlated to the performance of an activity , but which is not descriptive of it. For example, the number of production runs can be used as a surrogate activity driver for the materials disbursement activity if material disbursements coincide with the volume of production runs.

Accounting Tools

APRIL 23, 2023

Related Courses Activity-Based Costing Activity-Based Management What is an Activity Dictionary? An activity dictionary is a document that identifies and describes each of the activities within a business. It is a useful reference for anyone involved in an activity-based costing or activity-based management effort, since it provides a massive amount of information that can be incorporated into an analysis project.

Accounting Tools

APRIL 23, 2023

Related Courses Fixed Asset Accounting How to Audit Fixed Assets What is a Leasehold Improvement? A leasehold improvement is a customization of rental property. A tenant may want to invest in leasehold improvements in order to adjust the characteristics of office or production space to its specific needs. The landlord may pay for these improvements in order to improve future lease rates for the rental property, or to attract a good tenant.

Accounting Tools

APRIL 23, 2023

Related Courses Business Combinations and Consolidations CPA Firm Mergers and Acquisitions Divestitures and Spin-Offs Mergers and Acquisitions What is an Acquirer? An acquirer is an entity that obtains a majority interest in another business. This majority interest arises through an acquisition transaction, where the acquirer pays some form of consideration to the owners of the acquiree in exchange for their ownership interest.

Speaker: Robbie Bhathal, Founder & CEO, and Matthew Acalin, Head of Credit Intelligence

In today's volatile financial environment, how confident are you in your company’s financial forecasting? To get the most accurate cash predictions that will lead to long-term financial survival, real-time data is critical. Innovative cash management strategies can lead to better credit opportunities, more sustainable growth, and long-term financial prosperity.

Accounting Tools

APRIL 23, 2023

Related Courses Business Combinations and Consolidations CPA Firm Mergers and Acquisitions Divestitures and Spin-Offs Mergers and Acquisitions What is an Acquiree? An acquiree is a target company that is subject to an acquisition attempt by an acquirer. This may be done for a variety of reasons, such as gaining control of the acquiree’s intellectual property , unique assets, products, or skilled employees.

Accounting Tools

APRIL 23, 2023

Related Courses Accounting Information Systems Operations Management What is a Picking Ticket? A picking ticket is a list used to gather items to be shipped from a warehouse. The ticket contains the item number and item description, as well as the location code for the bin in which it is stored, the quantity to be picked, and the customer order number.

Accounting Tools

APRIL 23, 2023

Related Courses Business Combinations and Consolidations CPA Firm Mergers and Acquisitions Divestitures and Spin-Offs Mergers and Acquisitions What is the Acquisition Date? The acquisition date is the date on which an acquirer takes control of a target company from its former shareholders. The acquisition date is stated in the underlying acquisition agreement.

Accounting Tools

APRIL 23, 2023

Related Courses Cost Accounting Guidebook Financial Analysis Unit contribution margin is the remainder after all variable costs associated with a unit of sale are subtracted from the associated revenues. It is useful for establishing the minimum price at which to sell a unit (which is the variable cost). This margin analysis can apply to the sale of either goods or services.

Advertisement

All accounting teams know what it is like to dread the inevitable month-end scaries. If there was a way to feel less burdened and maybe even a little enthusiastic to work on your month-end close and reconciliation process, would you do it? No, don't answer that, of course you would! Automate your month-end close process by up to 40% with SkyStem's ART and see how much more alive you feel!

Accounting Tools

APRIL 23, 2023

What is an Agent? An agent is an individual or business that acts on behalf of another party. This authority may be express (via an agreement) or implied. An agent may enter into contractual relationships on behalf of its principal. The agent may trigger a liability for the principal when acting within the scope of its responsibilities for that party.

Accounting Tools

APRIL 23, 2023

Related Courses Guide to Audit Working Papers How to Conduct a Review Engagement How to Conduct an Audit Engagement What is a Paperless Audit? A paperless audit is when an auditor accesses the electronic records of a client in order to conduct an audit. Ideally, it also means that the auditor issues a final report in an electronic format, such as by e-mail or by posting the information on a secure site for downloading by a client.

Accounting Tools

APRIL 23, 2023

Related Courses Accounting for Retirement Benefits What is the Attribution Period? The attribution period is the time period over which the accrual is calculated for a post retirement benefit obligation. This period normally begins on an employee’s hire date and ends on the employee’s full eligibility date.

Accounting Tools

APRIL 23, 2023

Related Courses Business Ratios Guidebook Inventory Management The Interpretation of Financial Statements What is the Inventory Turnover Formula? The inventory turnover formula measures the rate at which inventory is used over a measurement period. It can be used to see if a business has an excessive inventory investment in comparison to its sales , which can indicate either unexpectedly low sales or poor inventory planning.

Advertisement

The status quo for AP in small and mid-market companies is broken. It consists of messy tech stacks of siloed solutions that give rise to manual work, a lack of control, wasted spend, and unnecessary risks. The benefits of shifting to spend management are tangible, measurable, and are felt across the whole organization. Spend management is a different way of thinking and an innovation whose time has come.

Accounting Tools

APRIL 23, 2023

Related Courses Corporate Cash Management Payables Management What is a Joint Endorsement? A joint endorsement is a requirement that both parties to whom a check has been paid must sign the back of the check. Otherwise, it will not be accepted by the bank for processing. This requirement is intended to keep one of the payees from cashing the check without the knowledge of the other payee.

Accounting Tools

APRIL 23, 2023

What is a Beneficial Conversion Feature? A beneficial conversion feature occurs when a conversion feature is in the money. This means that the conversion price of a convertible security is lower than the fair value of the instrument into which the convertible instrument is convertible. The holder of the convertible instrument realizes a benefit in the amount of this price difference.

Accounting Tools

APRIL 23, 2023

Related Courses Budgeting Budgeting | Closing the Books Value Pack Capital Budgeting Many companies go through the budgeting process every year simply because they did it the year before, but they do not know why they continue to create new budgets. What are the objectives of budgeting? They are: Provide structure. A budget is especially useful for giving a company guidance regarding the direction in which it is supposed to be going.

Accounting Tools

APRIL 23, 2023

Related Courses Business Ratios Guidebook The Interpretation of Financial Statements What is Return on Assets? The return on assets compares the net earnings of a business to its total assets. It provides an estimate of the efficiency of management in using assets to create a profit, and so is considered a key tool for evaluating management performance.

Speaker: Carolina Aponte - Owner and CEO, Caja Holdings LLC

In today's rapidly changing business environment, building a resilient balance sheet is crucial to the survival of any business. A resilient balance sheet allows a company to withstand financial shocks and adapt to changing market conditions. To achieve this, companies need to focus on key strategies such as maintaining adequate liquidity, managing debt levels, diversifying revenue streams, and prioritizing profitability over growth.

Let's personalize your content