Forwardly Instant Payments Debuts to Improve Cash Flow for SMBs

Insightful Accountant

JUNE 9, 2023

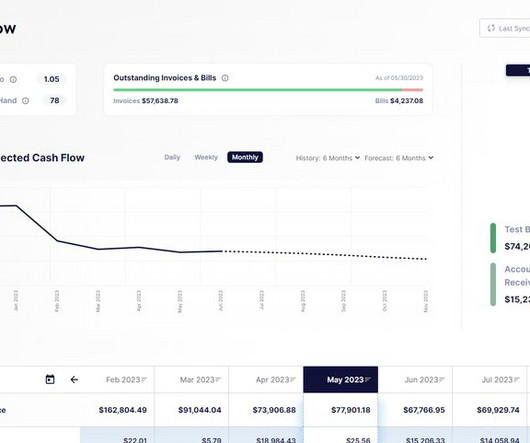

See how the First Real-Time Payments only solution empowers US businesses to get paid up to three days faster, while saving money on processing fees and streamlining workflows with automatic payment reconciliation.

Let's personalize your content