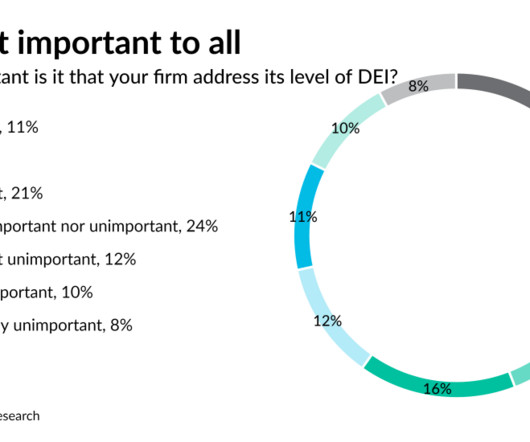

Inclusion in accounting: By the numbers

Accounting Today

NOVEMBER 26, 2023

Attitudes toward diversity, equity and inclusion are shifting in the profession — but slowly.

Accounting Today

NOVEMBER 26, 2023

Attitudes toward diversity, equity and inclusion are shifting in the profession — but slowly.

Xero

NOVEMBER 26, 2023

In the 2023 budget announcement, Singapore’s Minister for Finance announced the GST rate will increase from 8% to 9% on 1 January 2024. This change will impact all Singapore businesses that file GST. Here’s what we’re doing to make it easy for you to manage this change in Xero. Update your default rate We’ll make the new 9% rate available in Xero by 5 December 2023.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Insightful Accountant

NOVEMBER 26, 2023

QuickBooks Payroll will soon allow customers to split employee payroll costs into multiple classes and projects, ensuring accurate tracking without additional journal entries.

Accounting Tools

NOVEMBER 26, 2023

What is Trend Analysis? Trend analysis involves the collection of information from multiple time periods and plotting the information on a horizontal line for further review. The intent of this analysis is to spot actionable patterns in the presented information. In business, trend analysis is typically used in two ways, which are noted below. When trend analysis is being used to predict the future, keep in mind that the factors formerly impacting a data point may no longer be doing so to the sa

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

IMA's Count Me

NOVEMBER 26, 2023

Welcome to Count Me In! Join your host Adam Larson as he dives into insightful conversations with industry experts. In this episode, Adam is joined by Andrew Jamison , CEO & Co-Founder of Extend , a Point72-backed fintech platform that enables virtual card and spend management capabilities for small businesses. They discuss how small to medium-sized businesses can leverage fintech solutions to reshape their financial landscape.

Accounting Tools

NOVEMBER 26, 2023

Payroll fraud is the theft of cash from a business via the payroll processing system. There are several ways in which employees can commit payroll fraud, as noted below. Among the more common types of payroll fraud are not paying back an advance, buddy punching, and time sheet padding. Advance Retention Fraud The most passive type of fraud is when an employee requests an advance on his pay and then never pays it back.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Accounting Tools

NOVEMBER 26, 2023

What is a Check Payment? A check payment is a negotiable instrument drawn against deposited funds, to pay the recipient a specific amount of funds on demand. A check has traditionally been physically routed from the payer to the payee , then to the payee's bank, which issues funds to the payee, and then by the payee's bank to the payer's bank. The payer's bank then shifts funds from the payer's account to the payee's bank, thereby settling all accounts.

Accounting Tools

NOVEMBER 26, 2023

What are Short Term Notes Payable? Short term notes payable are obligations to pay a specified sum, plus interest , within one year. These notes payable usually refer to the repayment of loaned funds in the near term. The concept can also apply to the payment of accounts payable that have been converted into short term notes payable, probably because the buyer was unable to pay within terms.

Accounting Tools

NOVEMBER 26, 2023

What is a Subsidiary Company? A subsidiary company is a business entity that is controlled by another organization through ownership of a majority of its common stock. If the owning entity has acquired 100% of the shares of a subsidiary, the subsidiary is referred to as a wholly-owned subsidiary. This separate legal structure may be used to gain certain tax benefits, track the results of a separate business unit, segregate risk from the rest of the organization, or prepare certain assets for sal

Accounting Tools

NOVEMBER 26, 2023

What is a Stock Dividend? A stock dividend is the issuance by a corporation of its common stock to its common shareholders without any consideration. A dividend of this type is usually issued when a business does not have sufficient cash to spare for a normal dividend, but still wants to give the appearance of issuing a payment to its shareholders. This can happen when there is pressure from shareholders to issue a dividend.

Speaker: Robbie Bhathal, Founder & CEO, and Matthew Acalin, Head of Credit Intelligence

In today's volatile financial environment, how confident are you in your company’s financial forecasting? To get the most accurate cash predictions that will lead to long-term financial survival, real-time data is critical. Innovative cash management strategies can lead to better credit opportunities, more sustainable growth, and long-term financial prosperity.

Accounting Tools

NOVEMBER 26, 2023

What is Positive Pay? A positive pay system detects fraudulent checks at the point of presentment and prevents them from being paid. This means that checks that have had their payment amounts altered or which are derived from stolen check stock will be flagged by the bank. This is an effective way to stop check fraud. The basic positive pay steps are noted below.

Accounting Tools

NOVEMBER 26, 2023

What is Economic Nexus? Economic nexus is created when a business generates a certain amount of sales in a particular state. Some state governments measure this figure based on the overall dollar amount of transactions generated, while others combine the concept with the total number of individual sales transactions completed. A common threshold value is that sales tax remittances are required when an out-of-state seller’s sales into a state exceed $100,000 or 200 sales transactions within a cal

Accounting Tools

NOVEMBER 26, 2023

What is Accounts Payable Analysis? Accounts payable analysis is used to extract several types of information from the detailed accounts payable records. These analyses are noted below. A key outcome of this analysis is to alter payables processes to reduce the risk that any flaws found can recur in the future. Doing so can improve overall corporate profitability by avoiding excess expenditures.

Accounting Tools

NOVEMBER 26, 2023

What is a Petty Cash System? A petty cash system is a set of policies, procedures, controls, and forms that a company uses to dispense cash for various miscellaneous needs, such as office supplies and services. The basic process of setting up a petty cash system is: Location. Decide upon the locations where petty cash funds will be installed. There may be a single one for the entire company, or perhaps one per building or department.

Advertisement

All accounting teams know what it is like to dread the inevitable month-end scaries. If there was a way to feel less burdened and maybe even a little enthusiastic to work on your month-end close and reconciliation process, would you do it? No, don't answer that, of course you would! Automate your month-end close process by up to 40% with SkyStem's ART and see how much more alive you feel!

Let's personalize your content