The benefits of non-PO invoice process automation

Cevinio

FEBRUARY 25, 2024

Automating non-PO invoices alongside PO invoices brings numerous advantages, contributing to a more efficient and reliable financial process […]

Cevinio

FEBRUARY 25, 2024

Automating non-PO invoices alongside PO invoices brings numerous advantages, contributing to a more efficient and reliable financial process […]

Insightful Accountant

FEBRUARY 25, 2024

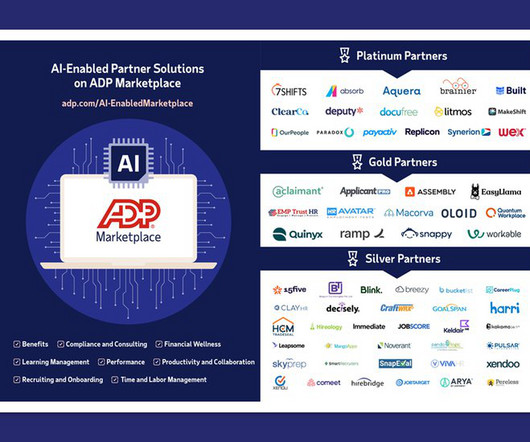

ADP® is offering AI-Enabled Partner Solutions on their powerful, simple and secure ADP Marketplace so HR leaders can rapidly source and implement the benefits of AI across their HCM ecosystems.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Tools

FEBRUARY 25, 2024

What is Net Present Value? Net present value (NPV) discounts the stream of expected cash flows associated with a proposed project to their current value, which presents a cash surplus or loss for the project. It is used to evaluate a proposed capital expenditure. A desirable investment is one that yields a positive net present value, which implies that a business will receive excess cash over time as a result of the investment.

Insightful Accountant

FEBRUARY 25, 2024

It’s that time of year when business owners get anxious and accountants get busy. We’re all preparing for March’s tax season!

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Accounting Tools

FEBRUARY 25, 2024

What is an Audit? In general, an audit is an investigation of an existing system, report, or entity. It may be conducted by either an internal or external party, depending on the situation. There are many types of audits that can be conducted, as noted below. Compliance Audit A compliance audit is an examination of the policies and procedures of an entity or department, to see if it is in compliance with internal or regulatory standards.

IMA's Count Me

FEBRUARY 25, 2024

Welcome to the Count Me In Podcast, where we bring you conversations with top industry professionals and thought leaders. In this episode, host Adam Larson sits down with Jonathan Smalley , Co-Founder at Proxymity , for a deep dive into shareholder engagement in the corporate world. They discuss the critical importance of strengthening shareholder engagement, the impact on investor relations, and the ongoing digital transformation of proxy voting.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Invoicera

FEBRUARY 25, 2024

Summary Leading electronic invoicing platforms are shaping financial management in the current year. Thus, we will discuss here: What is the significance of eInvoicing Features of the top 5 eInvoicing software solutions What are the pros and cons of each software Pricing structures and considerations Stay ahead of financial technology by considering these top e-invoicing software options for 2024.

Bookkeeping Essentials

FEBRUARY 25, 2024

What is CRA's position on cell phones and internet services required by sole proprietors to earn business income? Required by employees to perform work duties?

Accounting Tools

FEBRUARY 25, 2024

What are Solvency Ratios? Solvency ratios allow you to discern the ability of a business to remain solvent over the long term. They provide this insight by comparing different elements of an organization's financial statements. Solvency ratios are commonly used by lenders and in-house credit departments to determine the ability of customers to pay back their debts.

Accounting Tools

FEBRUARY 25, 2024

What is Cash Accounting? Cash accounting is an accounting methodology under which revenue is recognized when cash is received and expenses are recognized when cash is paid. It is most commonly used by smaller businesses, since it is easy to understand and does not require someone with an advanced knowledge of accounting practices. A larger business will use accrual accounting , where revenue is recognized when earned and expenses are recognized when incurred.

Speaker: Robbie Bhathal, Founder & CEO, and Matthew Acalin, Head of Credit Intelligence

In today's volatile financial environment, how confident are you in your company’s financial forecasting? To get the most accurate cash predictions that will lead to long-term financial survival, real-time data is critical. Innovative cash management strategies can lead to better credit opportunities, more sustainable growth, and long-term financial prosperity.

Let's personalize your content