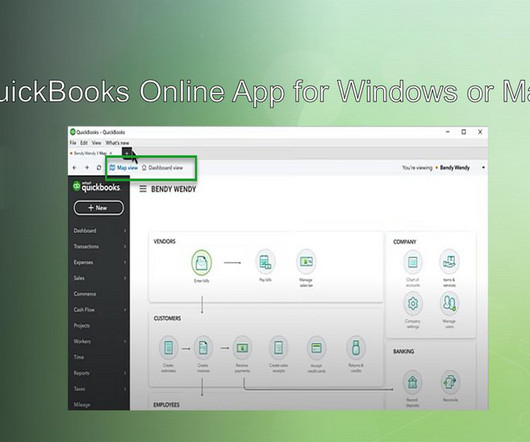

Work from anywhere with these new updates to our Xero apps

Xero

APRIL 11, 2023

Gone are the days when you need to sit at the desk to get those pesky admin jobs done. With our suite of mobile apps, you have real-time information about your business or practice at your fingertips, and can tick off those smaller tasks on the go. We’ve recently dialled up enhancements to our mobile apps, making it easier than ever to work from anywhere.

Let's personalize your content