Streamlining Accounts Payable with Automated AP Workflow Solutions

Ascend Software blog

MAY 2, 2023

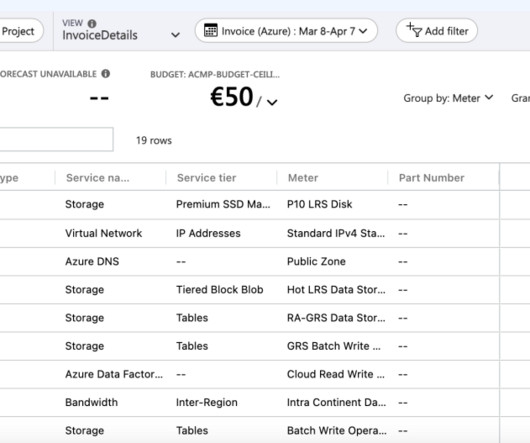

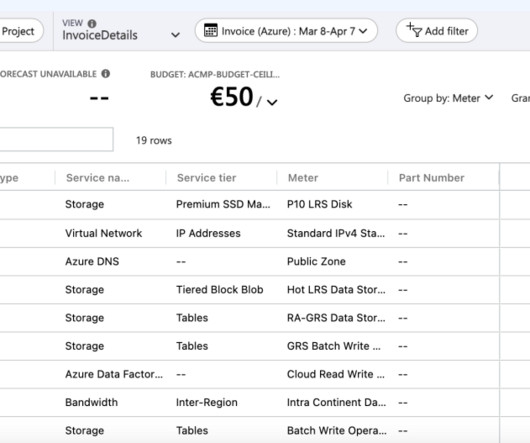

Accounts payable departments are an essential part of any organization, ensuring that suppliers and vendors are paid accurately and on time. However, the traditional paper-based invoice processing method is prone to errors, delays, and high costs, making it inefficient and time-consuming. Fortunately, advancements in technology have led to the development of automated AP workflow solutions that can streamline the accounts payable process and eliminate the need for manual intervention.

Let's personalize your content