Intuit plans appeal after judge rules that TurboTax can't be marketed as "free"

Accounting Today

SEPTEMBER 12, 2023

Intuit plans to appeal a recent legal decision which ruled that the company cannot claim TurboTax, which it owns, is "free.

Accounting Today

SEPTEMBER 12, 2023

Intuit plans to appeal a recent legal decision which ruled that the company cannot claim TurboTax, which it owns, is "free.

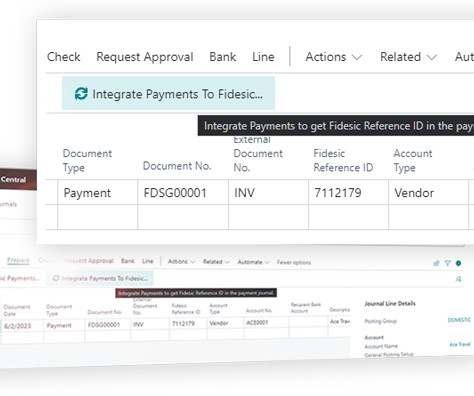

Fidesic blog

SEPTEMBER 12, 2023

A new AI powered invoice process solution for Microsoft D365 Business Central is a truly transformative piece of technology for accounts payable pros.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

SEPTEMBER 12, 2023

Are you wondering how artificial intelligence can revolutionize your accounting practice? We've got you covered.

Accounting Tools

SEPTEMBER 12, 2023

Related Courses How to Audit Payroll Optimal Accounting for Payroll Payroll Management The difference between a semimonthly and a biweekly payroll is that the semimonthly one is paid 24 times per year, and the biweekly one is paid 26 times per year. A semimonthly payroll is paid twice a month, usually on the 15th and last days of the month. If one of these pay dates falls on a weekend, the payroll is instead paid out on the preceding Friday.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Accounting Today

SEPTEMBER 12, 2023

Notice 2023-64 offers guidance on the 15% levy on large businesses — and waives some penalties.

Accounting Tools

SEPTEMBER 12, 2023

Related Courses Corporate Cash Management Foreign Currency Accounting What is a Foreign Exchange Contract? A foreign exchange contract is a legal arrangement in which the parties agree to transfer between them a certain amount of foreign exchange at a predetermined rate of exchange, and as of a predetermined date. These contracts are most commonly used when an organization buys from a foreign supplier , and wants to hedge against the risk of an unfavorable foreign exchange rate fluctuation befor

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Insightful Accountant

SEPTEMBER 12, 2023

Emburse has brought automated expense reports closer using AI Receipt scanning. Its new Emburse Transcription Engine enhances a mobile-first approach to simplify expenses and reduce out-of-policy spending.

Accounting Today

SEPTEMBER 12, 2023

Accountants need innovative tools to help ensure their firm is operating more efficiently and managing clients more effectively.

Insightful Accountant

SEPTEMBER 12, 2023

Insightful Accountant Publisher Gary DeHart sits down with Client Hub's Judie McCarthy to discuss the art of growing and scaling your accounting practice.

Accounting Today

SEPTEMBER 12, 2023

The Securities and Exchange Commission charged the former national assurance services leader at Marcum LLP with failing to address and remediate a number of deficiencies in the New York-based auditing firm's quality controls.

Speaker: Robbie Bhathal, Founder & CEO, and Matthew Acalin, Head of Credit Intelligence

In today's volatile financial environment, how confident are you in your company’s financial forecasting? To get the most accurate cash predictions that will lead to long-term financial survival, real-time data is critical. Innovative cash management strategies can lead to better credit opportunities, more sustainable growth, and long-term financial prosperity.

Insightful Accountant

SEPTEMBER 12, 2023

Remote Controller's Pete Audenas shows us how building a Toolbox, including Microsoft’s Power Platform, Azure & OpenAI, can drive your advisory revenue. Sign up for the webinar today.

Accounting Today

SEPTEMBER 12, 2023

The Public Company Accounting Oversight Board imposed a $30,000 civil penalty against K.R. Margetson, a firm in North Vancouver, British Columbia, and its sole partner, Keith R. Margetson, for quality control violations and revoked his firm's registration for a year.

Nanonets

SEPTEMBER 12, 2023

Kofax, a well-known player in the Intelligent Automation industry, has been a go-to choice for businesses seeking document capture, workflow management, and Robotic Process Automation (RPA) solutions. However, the ever-evolving market offers a variety of alternatives that provide similar functionalities and even unique features to cater to diverse business needs.

Accounting Today

SEPTEMBER 12, 2023

Three experts share the hot-button issues in malpractice liability for accountants — and key ways to protect a firm.

Advertisement

All accounting teams know what it is like to dread the inevitable month-end scaries. If there was a way to feel less burdened and maybe even a little enthusiastic to work on your month-end close and reconciliation process, would you do it? No, don't answer that, of course you would! Automate your month-end close process by up to 40% with SkyStem's ART and see how much more alive you feel!

CSI Accounting & Payroll

SEPTEMBER 12, 2023

Many small business owners dream of growing their operation. If you’re one of them, whether you’re an LLC or not, do you know which business entities your business can own? CSI Accounting & Payroll has worked with small business owners for over 50 years. When owners find growth with the help of our services, they often want to know how they can acquire another business.

Accounting Today

SEPTEMBER 12, 2023

Despite over two decades of experience, complying with the Sarbanes-Oxley Act of 2002 doesn't seem to be getting any easier for audit and finance leaders.

Tipalti

SEPTEMBER 12, 2023

As the economy emerges from the pandemic, digital transformation is accelerating in finace, this shift is motivating today's CFOs to take a more strategic

Accounting Today

SEPTEMBER 12, 2023

Future of contactless prep; reverse convenience; importance of the invoice; and other highlights from our favorite tax bloggers.

Advertisement

The status quo for AP in small and mid-market companies is broken. It consists of messy tech stacks of siloed solutions that give rise to manual work, a lack of control, wasted spend, and unnecessary risks. The benefits of shifting to spend management are tangible, measurable, and are felt across the whole organization. Spend management is a different way of thinking and an innovation whose time has come.

Tipalti

SEPTEMBER 12, 2023

CFOs at mid-size businesses are being pulled in dissonant ways, some of which are very new and dynamic—including challenges that seem outside the traditional

CloudZero

SEPTEMBER 12, 2023

Empower your engineering org to answer the question: When we spend a dollar in the cloud, how much do we get back?

Accounting Tools

SEPTEMBER 12, 2023

Related Courses Activity-Based Costing Cost Accounting Fundamentals Cost Management Guidebook What is Corporate Overhead? Corporate overhead is comprised of the costs incurred to run the administrative side of a business. These costs include the accounting, human resources, legal, marketing, and sales functions. When corporate costs are incurred, they are considered to be period costs , and so are charged to expense as incurred.

NACM

SEPTEMBER 12, 2023

NACM's Professional Certification Program gives credit professionals an opportunity to use their knowledge and skills to their advantage. Whether advancing your career, expanding your knowledge on basic information or even learning completely new skills, earning designations help credit professionals with career growth. Earning designations are not.

Speaker: Carolina Aponte - Owner and CEO, Caja Holdings LLC

In today's rapidly changing business environment, building a resilient balance sheet is crucial to the survival of any business. A resilient balance sheet allows a company to withstand financial shocks and adapt to changing market conditions. To achieve this, companies need to focus on key strategies such as maintaining adequate liquidity, managing debt levels, diversifying revenue streams, and prioritizing profitability over growth.

Accounting Tools

SEPTEMBER 12, 2023

Related Courses Budgeting Capital Budgeting Effective Sales Forecasting What is a Flexible Budget? A flexible budget adjusts to changes in actual revenue levels. Actual revenues or other activity measures are entered into the flexible budget once an accounting period has been completed, and it generates a budget that is specific to the inputs. The budget is then compared to actual expenses for control purposes.

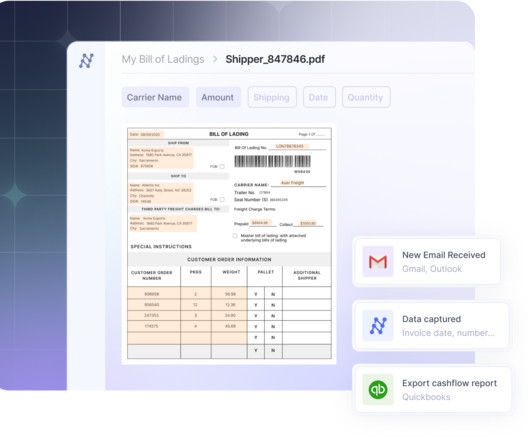

Nanonets

SEPTEMBER 12, 2023

Growing businesses often struggle to deal with sudden increases in invoices. Throw in manual invoice processing and siloed data and systems, and you've got a recipe for inefficiency and frustration. The cost of manually processing invoices can climb from $15 to $40 per invoice , not to mention the countless hours spent on data entry. In sharp contrast, automated invoice processing could reduce the cost to $1.42 per invoice , leading to significant cost savings.

Accounting Tools

SEPTEMBER 12, 2023

Related Courses Quality Management Fundamentals What are Failure Costs? Failure costs are those incurred by a manufacturer when it produces defective goods. There are two types of failure costs, which are internal and external. Internal failure costs occur before goods are shipped to customers , while external failure costs arise subsequent to shipment.

Accounting Tools

SEPTEMBER 12, 2023

What is the Private Sector? The private sector includes all parts of an economy that are not under the direct control of the government. This sector includes businesses that are owned by individuals or other firms. Entities that are owned or controlled by the government are classified as being part of the public sector. The private sector is driven by the need to earn a profit , while the public sector is driven by the provision of services to the general public.

Speaker: Wayne Spivak, President and CFO of SBA * Consulting Ltd., Industry Writer, Public Speaker

If you’re lost in the world of spend management needs and your GAP analysis is lacking perspective on the future state of your business performance, listen up! With the advancement of technology, the implementation of spend management best practices and concrete GAP analyses is more streamlined and accessible than ever before. And while this may sound like great news for you and your clients, it won’t be worthwhile unless you have the latest techniques to back up your ambitions!

Accounting Tools

SEPTEMBER 12, 2023

Related Courses Controller Education Bundle New Controller Guidebook What is a Flash Report? A flash report is a summary of the key operational and financial outcomes of a business. It is typically provided by the accounting department to the management team on a frequent basis, perhaps daily or weekly. The report is intended to point out issues that the management team can take action on.

Accounting Tools

SEPTEMBER 12, 2023

Related Courses Public Company Accounting and Finance The Interpretation of Financial Statements What are Financial Highlights? Financial highlights summarize the key monetary results of an organization. These highlights are usually set forth in a separate section of the financial report of a publicly-held company to its shareholders. The types of information that may be found in a financial highlights section include: Acquisition summaries Dividends Earnings per share Liquidity statistics Net c

Accounting Tools

SEPTEMBER 12, 2023

Related Courses Fixed Asset Accounting International Accounting What is a Revaluation? Revaluation is used to adjust the book value of a fixed asset to its current market value. This is an option under International Financial Reporting Standards , but is not allowed under Generally Accepted Accounting Principles. Once a business revalues a fixed asset, it carries the fixed asset at its fair value , less any subsequent accumulated depreciation and accumulated impairment losses.

Accounting Tools

SEPTEMBER 12, 2023

Related Courses Business Insurance Fundamentals Disaster Recovery Planning Enterprise Risk Management What is a Risk Transfer? A risk transfer occurs when one party deliberately shifts risk to a different entity, usually by purchasing an insurance policy. This risk may be shifted further, from an insurer to a reinsurer, so that the original insurer does not accumulate too much of a particular type of risk.

Advertisement

Developing a consistent month-end close doesn’t need to be a mystery. We’re sharing our top 10 secrets (plus one bonus!) for streamlining your close.

Let's personalize your content