Opportunity Cost Defined

Accounting Department

APRIL 18, 2023

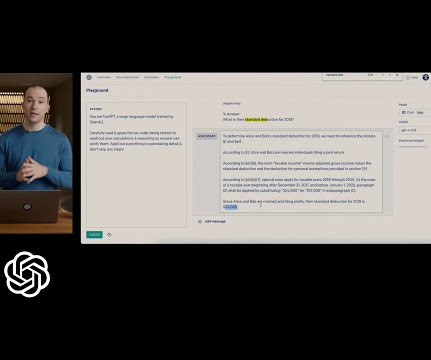

Opportunity cost is a concept in business that refers to the value of the best alternative forgone in order to pursue a certain action or decision. It is a crucial element to consider when evaluating the benefits and drawbacks of various options, particularly in business.

Let's personalize your content