Putting the ‘Tech’ in Spend Management Techniques

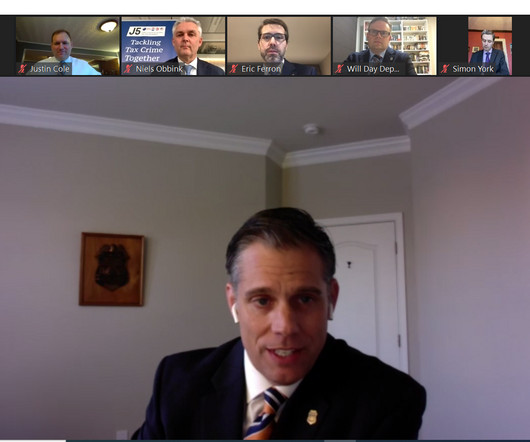

Speaker: Wayne Spivak, President and CFO of SBA * Consulting Ltd., Industry Writer, Public Speaker

If you’re lost in the world of spend management needs and your GAP analysis is lacking perspective on the future state of your business performance, listen up! With the advancement of technology, the implementation of spend management best practices and concrete GAP analyses is more streamlined and accessible than ever before. And while this may sound like great news for you and your clients, it won’t be worthwhile unless you have the latest techniques to back up your ambitions!

Let's personalize your content