How To Do Accounts Receivable Reconciliation

Nanonets

MAY 21, 2024

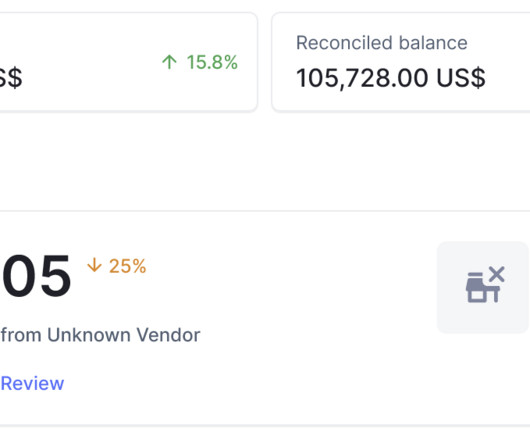

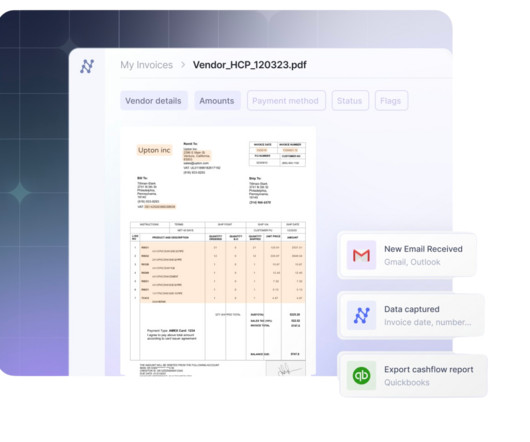

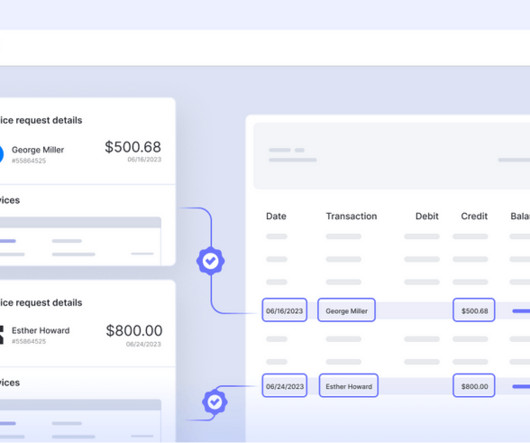

Accounts receivable reconciliation is a crucial process within accounting and financial management practices undertaken regularly by a business. Reconciling accounts receivable involves comparing the balances in the accounts receivable ledger with supporting documentation, such as invoices, receipts, and customer payments.

Let's personalize your content