Undoing Reconciliation in QuickBooks Online: A Step-by-Step Guide

Nanonets

FEBRUARY 19, 2024

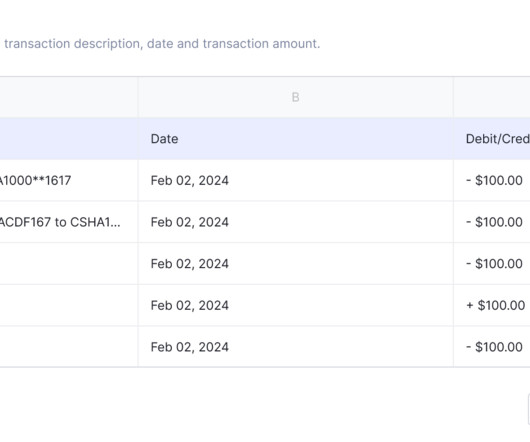

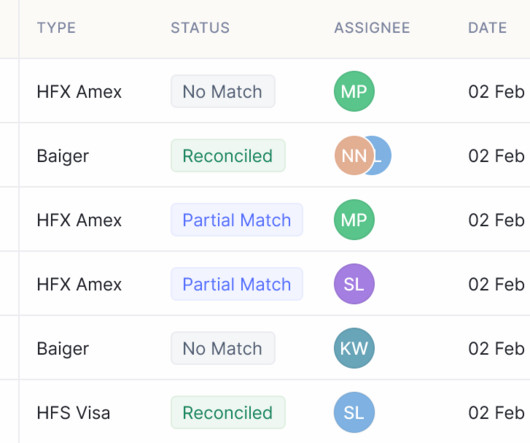

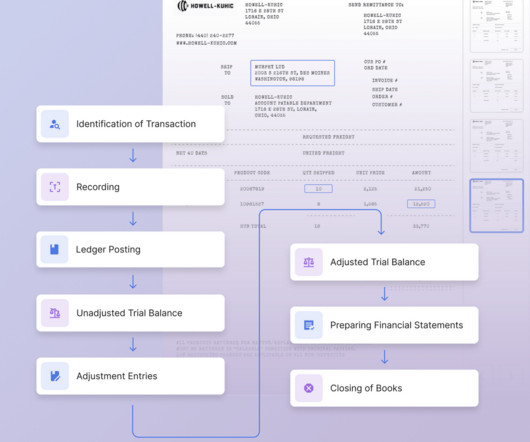

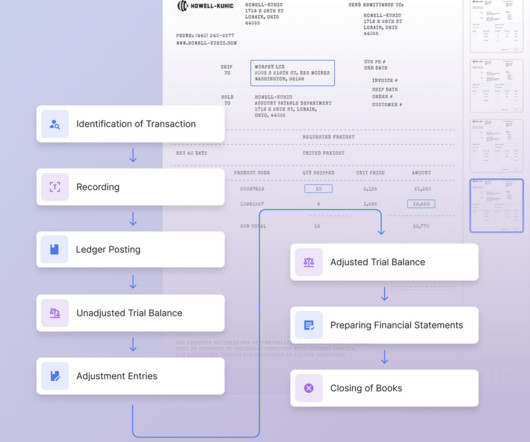

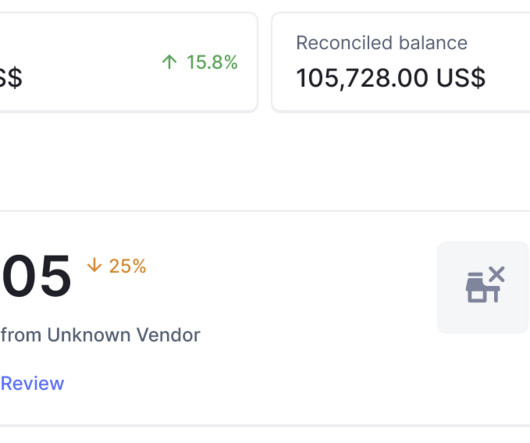

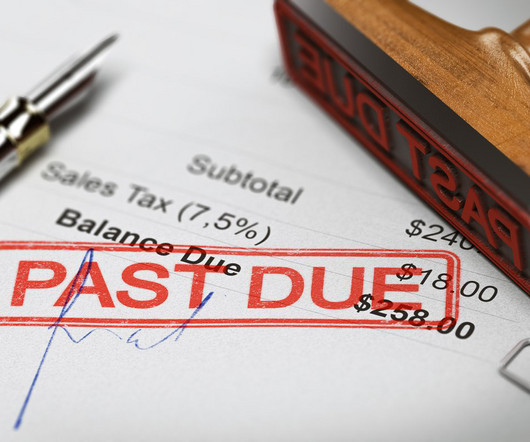

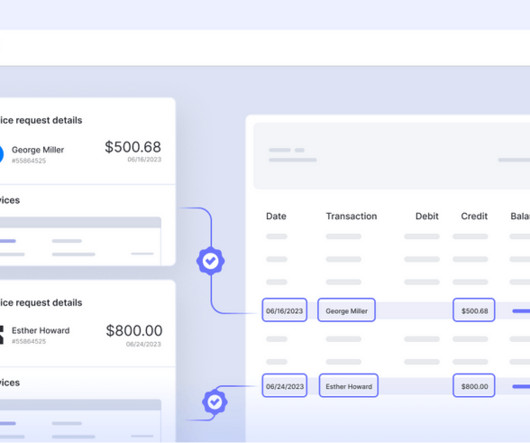

Introduction Diving into the world of accounting, reconciling accounts becomes a routine yet crucial task, especially when bank or credit card statements roll in. However, the dynamic nature of business means changes or oversights can occur, necessitating a revisit to previously reconciled accounts. The answer is a Yes.

Let's personalize your content