Outstanding Checks and Bank Reconciliation: Simplifying Financial Processes with Automation

Nanonets

APRIL 1, 2024

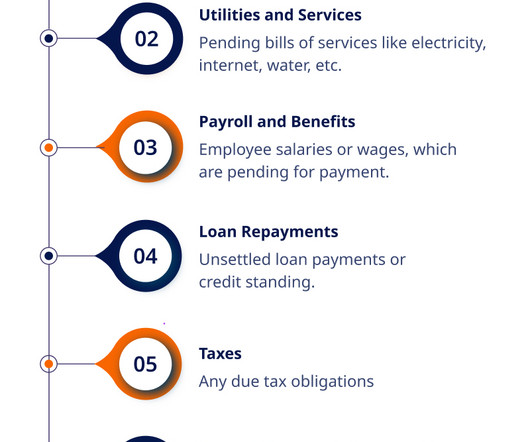

Whether it's ensuring that expenses align with available funds or guaranteeing that business transactions accurately reflect the company's financial standing, tracking checks outstanding and reconciling bank statements is non-negotiable.

Let's personalize your content