The importance of General Ledger reconciliation for financial reporting

Nanonets

JULY 21, 2023

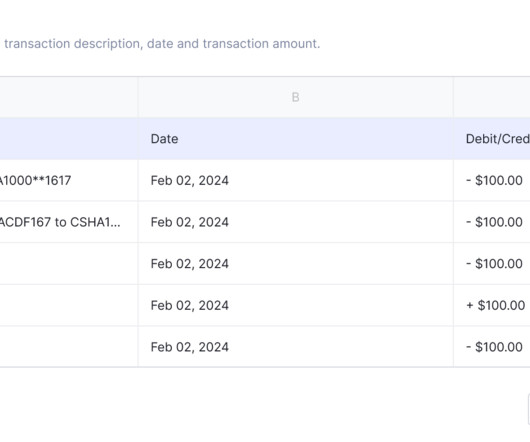

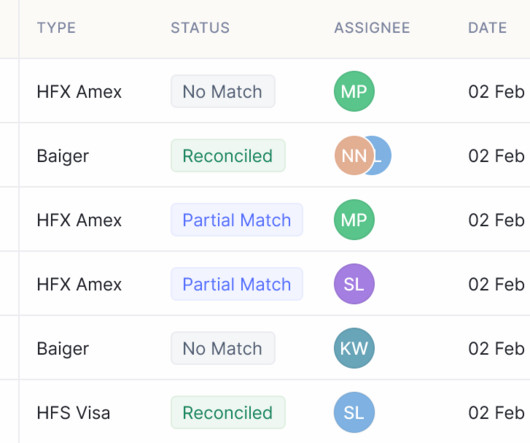

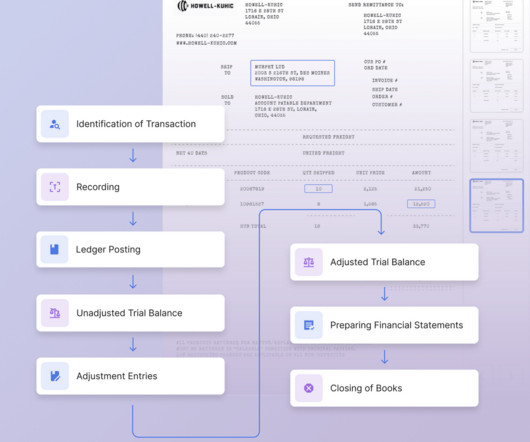

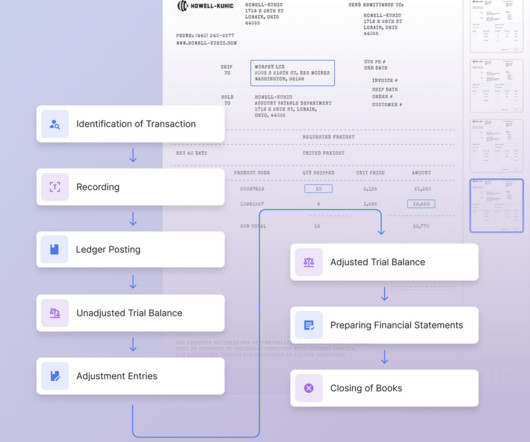

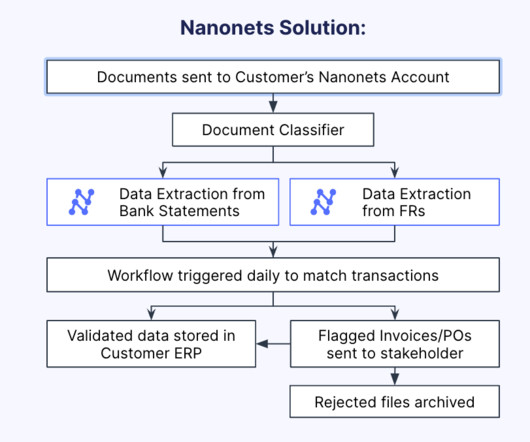

However, simply recording transactions in the general ledger is not sufficient to ensure accurate financial reporting. The process may vary depending on the complexity of the organization and the specific accounts being reconciled. It’s also imperative to reconcile the general ledger regularly.

Let's personalize your content