Get set up for the new tax year with Xero Payroll

Xero

MARCH 13, 2024

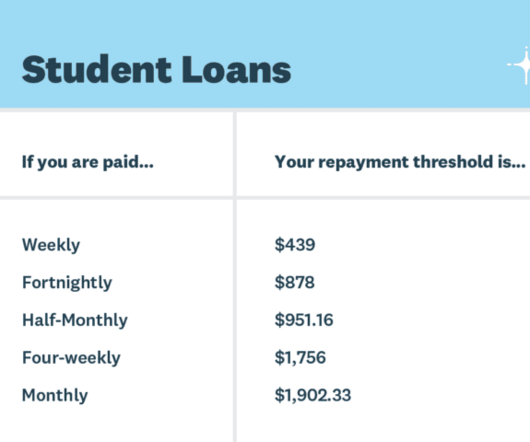

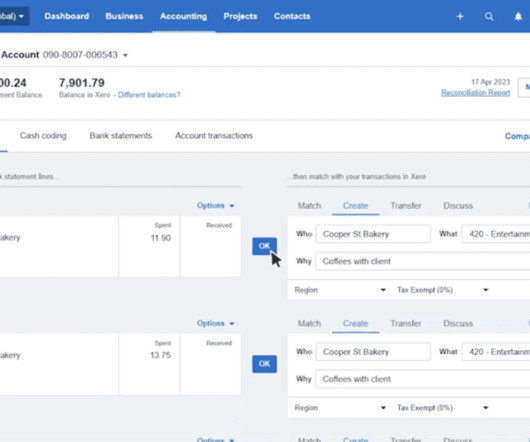

These include changes to National Insurance (NI) contributions effective from 6 January (followed by a second change effective 6 April), a new Scottish tax band and holiday pay reform. Reach out to them via Xero Central support , or check out our support articles and webinars. Employment allowance : Check if you are eligible.

Let's personalize your content