Reasons to come and visit Xero at Accountex London 2024

Xero

APRIL 25, 2024

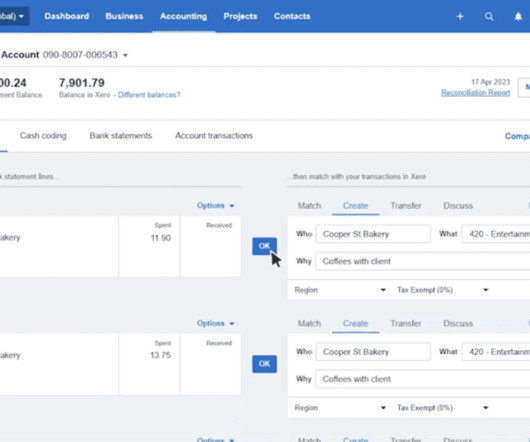

This year, we’re bringing our popular masterclasses back, along with a whole team of Xero experts to help you cultivate an efficient and rewarding practice. From tax to payroll – our masterclasses have you covered Our education team is bringing you masterclasses on the topics that matter most in your practice.

Let's personalize your content