By the numbers: Class actions, SEC audit clients and more

Accounting Today

MAY 21, 2025

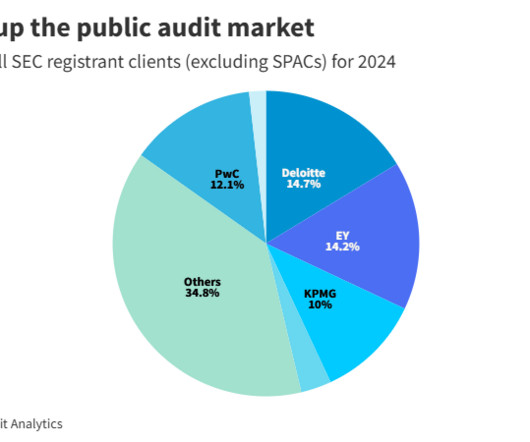

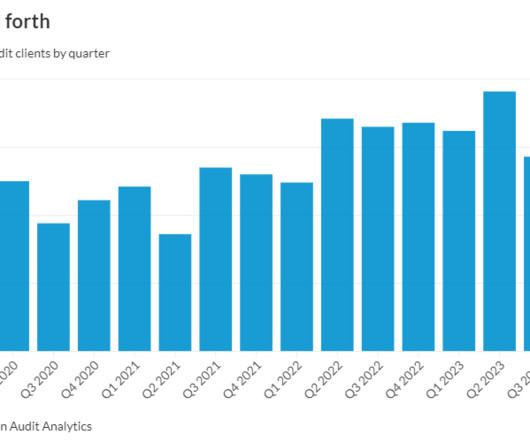

The latest data on new SEC audit client engagements for 2024 and the number of accounting-related securities class actions.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Accounting Today

MAY 21, 2025

The latest data on new SEC audit client engagements for 2024 and the number of accounting-related securities class actions.

Accounting Today

JUNE 16, 2025

EDT 1 Min Read Facebook Twitter LinkedIn Email The Public Company Accounting Oversight Board reported that deficiency rates remain high across examination, review and audit engagements for auditors of broker-dealers. Finally, audit engagement deficiencies increased across all firms.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Accounting Today

SEPTEMBER 3, 2024

The International Auditing and Assurance Standards Board 2023-2024 Handbook includes ISA 600 and ISA for LCE.

Accounting Today

JUNE 23, 2025

My firms compensation data, collected in 2024 and 2025, shows that accounting firms paid 7% more to bring in outside senior analysts in tax and audit than they paid internal staff in the same positions. With accounting talent in short supply, many firms are paying a premium for external hires instead of promoting their internal talent.

Accounting Today

JANUARY 24, 2024

Businesses are likely to see more sales tax audits in 2024 as a result of changes happening across the states, according to a new report.

Accounting Today

JUNE 20, 2025

It also applies to 2024 contributions to IRAs and health savings accounts for eligible taxpayers and to estimated tax payments normally due on April 15, June 16 and Sept. The current list of eligible localities is on the IRS Tax Relief in Disaster Situations page.)

Accounting Today

JUNE 26, 2025

1, 2024; and CPA Walter W. 20, 2024, and attorney Jason M. 10, 2024, and attorney Catherine E. 14, 2024, and CPA George O. 4, 2024; Enrolled Agent John A. Klein, in New City, New York, (effective July 22, 2024). Fulton, Agoura Hills, indefinite from March 18, 2025; CPA Mark L. Connecticut: Attorney Scott M.

Accounting Today

JUNE 12, 2025

After an IRS audit in 2016 assessed a federal tax debt totaling some $1 million, Archer concealed and transferred assets through two LLCs he controlled and began using third-party bank accounts to evade paying the tax debt. Fisher and Sinnott were convicted and sentenced to prison in January 2024.)

Accounting Today

JUNE 16, 2025

Accountants manage a high volume of sensitive information daily, covering everything from client tax details and payroll reports to audit documentation and financial disclosures. million in 2024 , this has never been a more pressing issue. And with the average cost of data breaches reaching an all time high of $4.88

Accounting Today

OCTOBER 30, 2024

A potential recession is the biggest economic risk factor that audit partners foresee over the next 12 months, followed by regulations and geopolitical instability, according to a survey by the Center for Audit Quality.

Accounting Today

DECEMBER 13, 2023

The Securities and Exchange Commission approved the 2024 budget of the Public Company Accounting Oversight Board, totaling $384.7 million, with an accounting support fee totaling $358.8 million.

Accounting Today

DECEMBER 12, 2023

2024 will be a demanding year for internal auditors who will be facing new requirements and updated standards.

Accounting Today

AUGUST 19, 2024

Enforcement by the Public Company Accounting Oversight Board against auditors in 2024 is off to its fastest start in recent years.

Compleatable

JUNE 19, 2025

36% ended 2024 in the red—the highest operating deficit in a decade. Scale Isn’t Optional Despite these financial issues, non-profits are still expanding to meet needs: 63% added services in 2024. Conduct recurring spend audits , that forgotten subscription or auto-renewal could be cash in hand.

Xero

MAY 28, 2025

More than half (54%) of Australians are worried about making an error on their tax return: key concerns included owing money to the Australian Taxation Office (33%), following tax rules correctly (28%), and being audited by the ATO (22%). Fieldwork was undertaken between 10 and 19 May 2024. For Australias 2.6

Accounting Today

JUNE 19, 2025

Yager used clients information to present false returns to the IRS from November 2023 through March of 2024, submitting returns in the name of her clients without their knowledge or approval. Nixa, Missouri: Tax preparer Tina Louise Yager has pleaded guilty to making false and fictitious claims against the U.S. and to wire fraud.

Accounting Today

JUNE 4, 2024

The report highlights the International Ethics Standards Board for Accountants' yearly accomplishments and outlines future plans, like focusing on sustainability.

Accounting Today

FEBRUARY 26, 2025

The Public Company Accounting Oversight Board increased its enforcement activity in 2024 to its highest level since 2017, according to a new report.

Accounting Today

MARCH 19, 2024

GreenGrowth CPAs dominated the league tables in the last quarter of 2024, adding 30 new clients through two acquisitions.

Accounting Today

NOVEMBER 16, 2023

The board voted to approve a new budget for fiscal 2024 and revealed it surpassed last year's record amount of fines.

Accounting Today

JUNE 17, 2025

Milan Jaros/Bloomberg The firm is backed by private equity firm New Mountain Capital, which acquired its majority stake in March 2024 after selling a majority stake in Top 100 Firm Citrin Cooperman. By Paige Hagy June 16 Like what you see?

accountingfly

JULY 18, 2024

The post Top Remote Accounting Candidates for Hire | July 18, 2024 appeared first on Accountingfly. Sign up now to find your next hire.

Intuit

APRIL 21, 2025

It evaluates candidates understanding of essential accounting principles, auditing procedures, business law, and ethical standards. The 3 Core exam sections are: Auditing and Attestation (AUD): This section contains 78 multiple-choice questions and 7 simulations based on CPA tasks and ethical behavior.

accountingfly

APRIL 4, 2024

Salary: $80K – $85K Time zone: CT Sign up to learn more about this candidate The post Top Remote Accountants for Hire | April 4, 2024 appeared first on Accountingfly. Tech Stack: QBO, QBD, Bill.com (Certified), Gusto (Certified), automatic bank feeds, etc.

Accounting Today

JUNE 13, 2025

across four sections of the Uniform CPA Examination, pass the four sections on their first attempt and have completed testing in 2024. MISSOURI Zane Kvasnicka Zane Kvasnicka was hired as a business valuation specialist in the management consulting practice at KPM CPAs & Advisors. Read the full story.) OHIO Cohen & Co.,

Accounting Today

JANUARY 16, 2024

Swag taxes; audit ROI; your best reading for 2024; and other highlights from our favorite tax bloggers.

Xero

JANUARY 29, 2024

That’s why we’re retiring the classic version of invoicing on 2 September 2024 at 9am NZT. In some time zones, this will mean that classic invoicing will not be available from 1 September 2024. To do this, they need to focus their attention on new invoicing, rather than maintaining the older version that is now outdated.

Accounting Today

DECEMBER 20, 2023

The board released a staff report outlining its inspections plans and highlighting key risks.

Compleatable

JULY 3, 2025

billion in 2024 to $18.4 More importantly, you’re building a closed-loop system, from purchase to payment confirmation, that’s trackable and auditable. The financial automation market is on a steep growth trajectory. billion by 2030 , with a compound annual growth rate of 14.6%.

Accounting Today

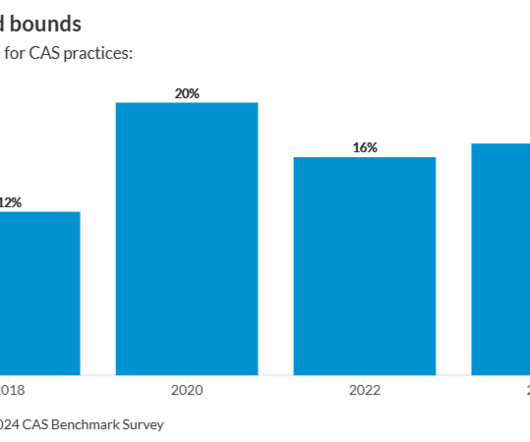

JANUARY 16, 2025

The latest data on revenue growth for CAS practices, statistics from IRS Criminal Investigation for the full year of 2024, and other major metrics.

accountingfly

NOVEMBER 21, 2024

The post Top Remote Accounting Candidates for Hire | November 21, 2024 appeared first on Accountingfly. Sign up now to check out Top Candidates.

Xero

JUNE 19, 2024

Earlier this year we communicated that we’ll be retiring the older version of our invoicing product – classic invoicing – on 2 September 2024. You’ve told us it’s important to have an audit trail of what was changed in an invoice as well as who it was sent to. Does new invoicing support repeating invoices?

accountingfly

MARCH 29, 2024

Emphasis in audit and accounting with 30 years at the same CPA firm. Remote Work Experience: Y Goal: Looking for a Sr/Manager or partner-level role in Audit and/or Accounting where he can use his expert-level skill-set for a firm that is looking to grow. Open to both full-time permanent or full-time contract roles.

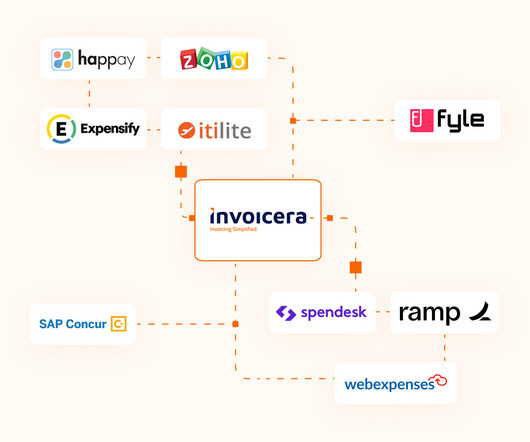

Invoicera

NOVEMBER 23, 2023

We’ll dive into the top 10 expense management tools for 2024 and beyond. Regular Audits and Updates: A reputable expense management tool conducts regular security audits and updates to identify vulnerabilities and patch them promptly. This prevents unauthorized individuals from accessing sensitive financial data.

Accounting Today

NOVEMBER 16, 2023

A recent survey has found internal auditors are optimistic about the economy and about the availability of talent going into 2024 despite ongoing risks in both areas.

accountingfly

OCTOBER 24, 2024

The post Top Remote Accounting Candidates for Hire | October 24, 2024 appeared first on Accountingfly. Sign up now to check out Top Candidates.

accountingfly

NOVEMBER 14, 2024

The post Top Remote Accounting Candidates for Hire | November 14, 2024 appeared first on Accountingfly. Sign up now to check out Top Candidates.

Nolan Accounting Center

FEBRUARY 15, 2025

In 2024, about 22 million Americans worked full-time from home (or some other location), representing about 14% of all employed adults. Accurate record-keeping and proper expense documentation are critical to avoid the problems of an audit. How Many People Work Remotely?

AvidXchange

JANUARY 2, 2025

Identifying signs like frequent errors, late payments , or audit challenges can highlight the need for automation. Audit Challenges Accounts payable audits can be tedious and time-consuming. If your last audit did not go smoothly, it may be time to consider making a change. It might be time for a change.

AvidXchange

DECEMBER 20, 2024

For the 2024 tax year, businesses must issue a 1099-NEC to recipients and file it with the IRS by January 31, 2025, according to the IRS. In 2024, the IRS issued guidance making it mandatory for any business filing more than 10 information returns to do so electronically.

Nanonets

JANUARY 1, 2024

In this blog, we'll delve into what invoice audits entail and why they are crucial for the financial integrity of businesses. What is an Accounts Payable Audit? An Account Payable Audit is a process by which the financial records of the accounts payable department are examined by an auditor.

Outsourced Bookeeping

NOVEMBER 15, 2024

SMEs Can Navigate Tax Law Changes in 2024 With such challenges, firms should know how to shrink the impact of these alterations and minimise their tax liabilities while maximising their deductions. tax laws in 2024, keep reading. Small Business Tax Planning in 2024 When it comes to compliances, deductions and U.S.

Counto

APRIL 26, 2025

As of 2024, eligible working fathers are entitled to two weeks of Government-Paid Paternity Leave (GPPL). What Changed in 2024? From 1 January 2024, the Government increased the GPPL from two weeks to four weeks, but only the first two weeks are mandatory. Let our experts manage your payroll compliance end-to-end.

accountingfly

FEBRUARY 29, 2024

Accountingfly Monthly Hiring Update: February 2024 Welcome to Accountingfly’s new monthly market update for accounting leaders! For the last three years, quality public accounting audit candidates have been extremely hard to find. Salary News: 2024 Salary Growth Report; Tax Managers Command a Premium?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content