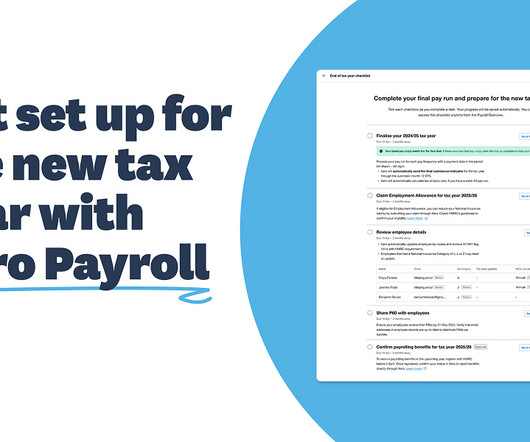

Blast past tax time stress this EOFY: Steps to process and finalise payroll

Xero

JUNE 6, 2025

The 2025 Financial Year is almost at an end, so there has never been a better time to prepare. Post and file any pay runs for the 2024/2025 financial year Any pay runs with a payment date in this financial year will need to be posted and filed before you complete this year’s payroll finalisation. Not sure where to start?

Let's personalize your content