BDO's Berson to retire in 2026

Accounting Today

MAY 29, 2025

BDO USA's CEO Wayne Berson will retire effective June 30, 2026, and national managing principal of tax Matthew Becker has been tapped to succeed him.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

2026 Related Topics

2026 Related Topics

Accounting Today

MAY 29, 2025

BDO USA's CEO Wayne Berson will retire effective June 30, 2026, and national managing principal of tax Matthew Becker has been tapped to succeed him.

Accounting Today

JUNE 6, 2025

The recent announcement of the CIMA/CGMA 2026 syllabus has made it unmistakably clear: Merely knowing how to post journal entries is insufficient. The CIMA/CGMA proposal for 2026 is not just a curriculum update; it is a powerful manifesto. The 2026 curriculum is a clear indication of the changes underway.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

AI In Accounting: A Practical Roadmap For Smarter AP

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Precision in Motion: Why Process Optimization Is the Future of Manufacturing

Stop Budget Burnout: A Better Way to Grow Your Nonprofit in 2026

Accounting Today

JULY 9, 2025

EDT 1 Min Read Facebook Twitter LinkedIn Email Andrew Harrer/Bloomberg Tax year 2026 and filing season 2027 are the target date for retiring the Filing Information Returns Electronic, or FIRE, system. FIRE will not be available for submissions in filing season 2027.

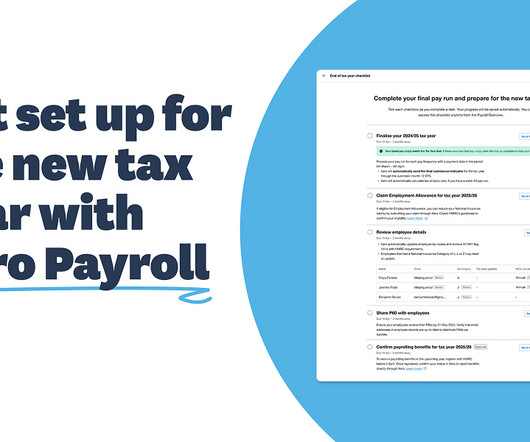

Xero

JUNE 3, 2025

From April 2026, small businesses, sole traders and landlords will need to change how they report income tax to HMRC. Anyone with an annual turnover of over 50,000 for the tax 24/25 year will need to start complying from April 2026. The MTD for IT rollout will happen in phases.

Speaker: Sean Yoder

Nonprofits are under more pressure than ever to demonstrate financial accountability while continuing to expand their impact. Traditional budgeting models often fall short, reinforcing silos, limiting flexibility, and stalling growth.

Xero

FEBRUARY 26, 2025

In April 2026, Making Tax Digital for Income Tax (MTD for IT) will be introduced, and its set to shake up the record keeping, reporting and tax requirements for self-employed people and landlords. The next phase of Making Tax Digital is coming.

Accounting Today

SEPTEMBER 13, 2024

Gartner estimates that, by 2026, around 80% of independent software vendors will embed gen AI capabilities in enterprise applications, versus less than 1% in 2023.

Accounting Today

JULY 9, 2025

Matthew Becker, BDO USA's national managing principal of tax, has been ratified by a principal-wide vote to succeed Wayne Berson as the firm's next CEO, effective July 1, 2026.

Xero

DECEMBER 4, 2024

The requirements for small businesses and their accountants are due to be phased in over 2026 and 2027. While this law directly targets businesses with more than 100 employees, the impact will inevitably trickle down to their suppliers, who may need to provide emissions data to them.

Accounting Today

FEBRUARY 27, 2025

Wolters Kluwer CEO Nancy McKinstry said she will retire in 2026. Wolters Kluwer intends for Stacey Caywood, current CEO of Wolters Kluwer Health, to be the new CEO next year.

Accounting Today

SEPTEMBER 11, 2024

The OZ program allows investors to defer their capital gains from sales of appreciated real estate, stocks, businesses, personal residences, collectibles and even crypto through 2026.

Xero

MARCH 25, 2025

Payroll benefits From April 2026, a new UK government mandate will require employees benefits (like company cars, insurance) to be reported via payroll, meaning you wont need the P11D form across most benefits. Employers wont need to include loans or accommodation in payroll right away, this will be optional from April 2026.

Accounting Today

AUGUST 25, 2022

(..)

Insightful Accountant

JULY 8, 2025

Last week I began a new mini-series on the 2026 Awards. This year the awards will see a fourth 'group', "Top 25 Tax Advisors" will come alongside the Top 100 ProAdvisors, the Top 25 Up-n-coming ProAdvisors, and the Top 50 International ProAdvisors.

Fidesic blog

APRIL 13, 2023

You may have recently heard that Microsoft Dynamics GP and Business Central on-premise will no longer be sold to new customers after 2026. In this post we will discuss the situation with GP and what is possible. We are offering information, not advice.

Accounting Today

OCTOBER 4, 2022

(..)

Accounting Today

NOVEMBER 25, 2024

10, 2026. The Internal Revenue Service is extending the transition period for revising claims for the research and development tax credit through Jan.

Accounting Today

AUGUST 25, 2023

The Internal Revenue Service is giving people until 2026 to comply with a new requirement for Roth catch-up contributions.

Fidesic blog

APRIL 4, 2023

(UPDATE) Microsoft has announced new customer sales of Microsoft Dynamics GP will end April 2026. They can continue to purchase new licenses and modules beyond 2026. "We They can continue to purchase new licenses and modules beyond 2026. Starting April 1, 2026 new customer sales of Dynamics GP end.

Accounting Today

MAY 13, 2025

The Chartered Institute of Management Accountants updated its CGMA Professional Qualifications Syllabus for 2026 to emphasize finance business partnering and applied problem solving.

Accounting Today

JUNE 17, 2025

Sovos ( [link] ): The IRS will decommission the Filing Information Returns Electronically system in January 2027; all 2026 returns will need to use the new IRS Information Returns Intake System. The window for preparation is closing fast.

Accounting Today

JUNE 23, 2025

Most of the questions deal with Statement 103 , the financial reporting model improvements standard that GASB issued last year, which will take effect in 2026. He hopes to issue an exposure draft, with another round of due process on a document written more like a final standard in early 2026 with a final standard expected in early 2027.

Accounting Today

JULY 9, 2025

Accounting Technology Fraud prevention Fraud MORE FROM ACCOUNTING TODAY Practice management BDO names Matt Becker next CEO Matthew Becker, BDO USAs national managing principal of tax, has been ratified by a principal-wide vote to succeed Wayne Berson as the firms next CEO, effective July 1, 2026.

Accounting Today

JUNE 20, 2025

Taxpayers have up to six months after the due date of their federal income tax return for the disaster year (without regard to any extension of time to file) to make the election. For individual taxpayers, this means Oct. Jeff Stimpson Freelance writer For reprint and licensing requests for this article, click here.

Counto

MARCH 5, 2024

Singapore to Raise Retirement Age to 64 by 2026 In a move towards fostering inclusive and progressive workplaces, Singapore’s retirement age is set to rise to 64 years old in 2026, announced by Minister of Manpower Tan See Leng during the Committee of Supply debate in Parliament.

Xero

DECEMBER 20, 2022

HMRC has announced that Making Tax Digital (MTD) for Income Tax Self Assessment (ITSA) has been delayed until April 2026. Apr 2026: MTD for ITSA – businesses, self-employed individuals, and landlords with income over £50,000. The new MTD for ITSA timeline. Here are the key dates you need to know when preparing for MTD for ITSA:

Xero

DECEMBER 20, 2022

Through this long-term partnership agreement, which will run until 2026, we’re aiming to build on increased interest in the beautiful game that will no doubt be supercharged by the FIFA Women’s World Cup 2023 held in New Zealand and Australia.

Accounting Today

MARCH 21, 2025

The American Institute of CPAs' Auditing Standards Board is looking for feedback on its proposed strategic plan for 2026-30.

Accounting Today

JULY 9, 2025

By Paige Hagy 11h ago Practice management M&A roundup: Meaden & Moore; Platform Accounting expand Meaden & Moore acquires ChainRing Advisors; Platform Accounting expands in Chicago.

Ontrack Bookkeeping

JULY 1, 2025

per year to receive this full entitlement) Eligibility for KiwiSaver contributions will be expanded to include 16+17 year old Kiwis – they will be eligible for Government Contributions 1 July 2025 and Employer Contributions from 1 April 2026. starting in April 2026, and then to 4% from April 2028.

Compleatable

JUNE 9, 2025

Periods Reported: Historic Actuals September 2023 – March 2024 April 2024 – August 2024 Forecasted September 2024 – March 2025 April 2025 – August 2025 September 2025 – March 2026 April 2026 – August 2026 Summary Forecasts September 2026 – August 2027 September 2027 – August 2028 The first actuals period may be pre-populated (..)

Compleatable

MARCH 24, 2025

The Department for Educations recent release of the National Insurance Contributions (NICs) grant methodology for April 2025 to March 2026 highlights a critical issue for school and trust leaders: the growing complexity of cash flow management in the face of rising employment costs.

Insightful Accountant

APRIL 22, 2025

The 2026 ProAdvisor Awards will see consolidation of the Desktop and Desktop Enterprise categorical awards.

Accounting Today

DECEMBER 6, 2024

KPMG International forecasts slight growth in global GDP in 2025, then dampening in 2026 due to post-election policies in the U.S.

Accounting Today

NOVEMBER 20, 2024

31, 2026. Gabriela Figueiredo Dias, chair of the International Ethics Standards Board for Accountants, has been reappointed for a second term through Dec.

Fidesic blog

DECEMBER 5, 2024

Subscription licenses can still be purchased for one year April 1, 2026: No new customer sales of Dynamics GP of any kind December 31, 2029: End of product enhancements, regulatory (tax) updates, service packs and technical support. Microsoft has announced new customer sales of Microsoft Dynamics GP will end April 2026.

Counto

FEBRUARY 20, 2025

The government will now co-fund 40% of wage increases in 2025 (up from 30%) and 20% in 2026 (up from 15%) for lower-wage workers. Plus, if you have at least three resident employees, you’ll receive an additional SG$10,000 in SkillsFuture Enterprise Credit from late 2026, making it easier to invest in your team’s capabilities.

Trade Credit & Liquidity Management

JULY 9, 2025

Eftsure’s integration into Nacha’s Preferred Partner Program supports compliance with Nacha Operating Rules and upcoming 2026 rule changes, helping businesses reduce payment fraud risks while advancing the ACH Network’s security and reliability. Nacha governs the ACH Network, which processed 33.6

Blake Oliver

FEBRUARY 18, 2025

Starting in January 2026 , accountants will have two options: A Bachelor's degree plus 2 years of experience A Master's degree plus 1 year of experience. Virginia just became the second state to create an alternative CPA pathway.

Counto

DECEMBER 15, 2024

The Ordinary Wage Ceiling Will Increase Starting from 1 January 2025, the CPF Ordinary Wage (OW) ceiling will gradually rise, with the full increase expected by 2026. This change is part of the governments efforts to ensure that CPF contributions reflect the growing wages of Singapores workforce.

Ace Cloud Hosting

MAY 15, 2024

billion by 2026, according to new market research, at an expansion rate of 8.6 According to Accounting Today, “The accounting software market will have a global value of $11.8 percent.

Accounting Today

JUNE 27, 2025

Their co-managing roles are scheduled to last a year, with Andrews assuming the managing partner role on July 1, 2026, and becoming the first female and first non-Plung family member in that position in the firms 104-year history. Pittsburgh.

Xero

FEBRUARY 15, 2023

billion in 2026, according to IDC’s latest Worldwide Artificial Intelligence Spending Guide. Spending on AI systems (including hardware, software, and services) is set to rise in Asia Pacific from $20.6 billion in 2022 to $46.6

CSI Accounting & Payroll

SEPTEMBER 15, 2024

If you’re a small business owner who has provided paid FMLA leave to an employee, you may have heard about this credit. It can be a great way to earn back some of the wages you paid your employee while they were gone.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content