How to Detect and Prevent Accounts Receivable Fraud in 2025

Gaviti

MARCH 5, 2025

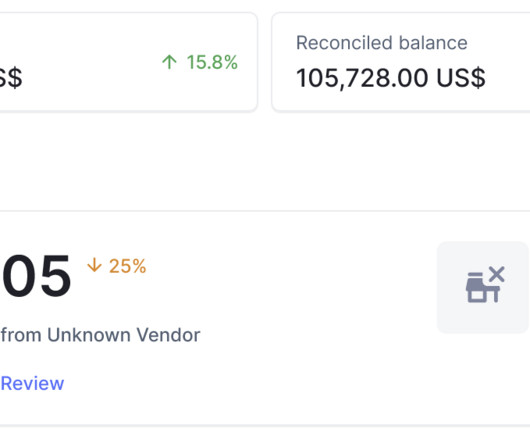

Accounts receivable fraud is becoming an increasingly pressing threat for businesses of all sizes, especially companies that grow or make a lot of changes. What makes Accounts Receivable Professionals and Operations Especially Vulnerable to Fraud?

Let's personalize your content