Unlock Efficiency with Small Business Accounting Software

Nanonets

SEPTEMBER 23, 2023

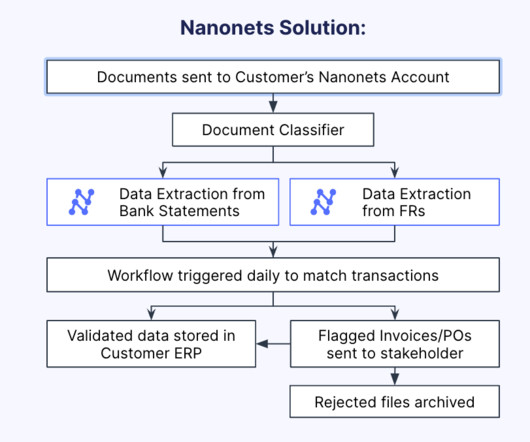

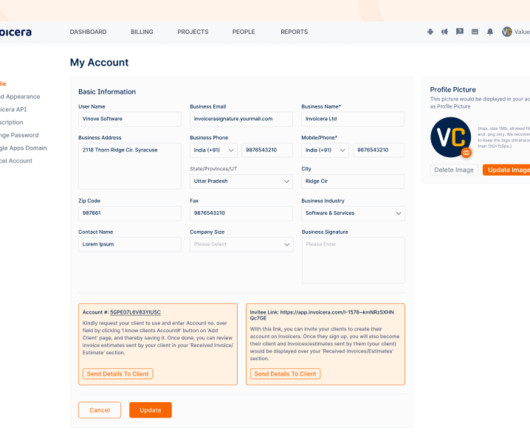

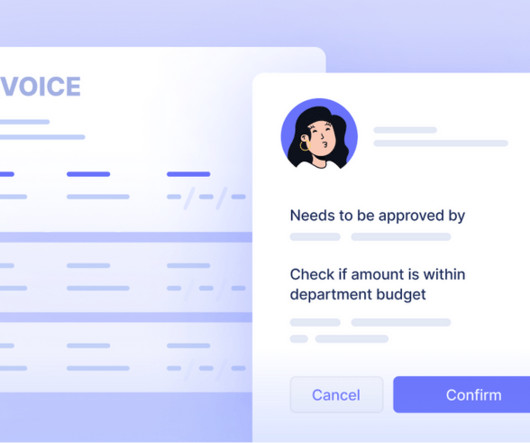

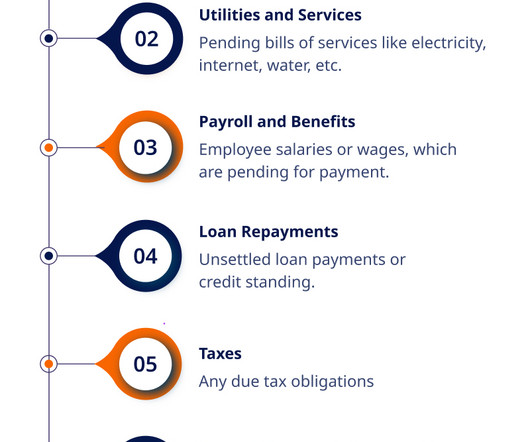

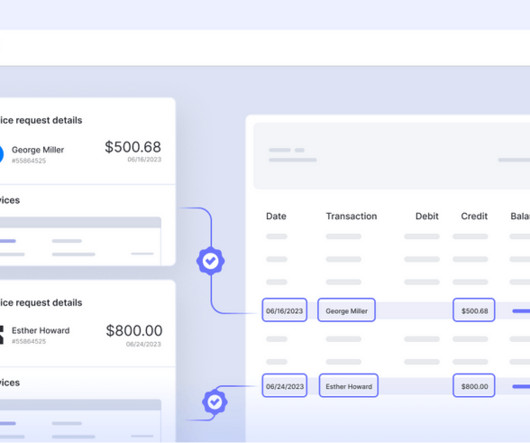

Small business accounting software can unlock efficiency and streamline financial management for businesses of all sizes. By replacing traditional manual methods with automated systems, accounting software saves time, reduces the risk of errors, and provides valuable insights into financial transactions.

Let's personalize your content