8 Tips to Optimize Record-Keeping for Small Businesses

Bookkeeping Express

JULY 26, 2023

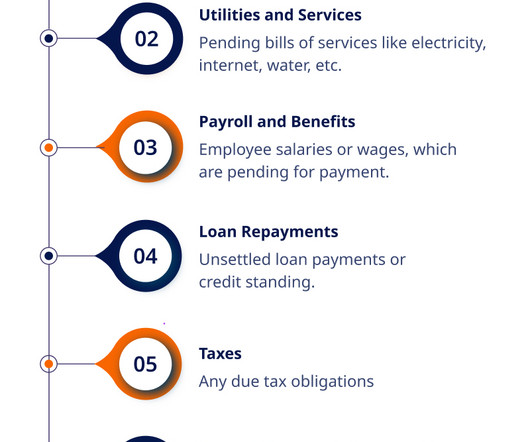

Among the various financial practices, record-keeping stands out as a fundamental aspect that cannot be overlooked. Accurate and consistent record-keeping is the backbone of any successful business, providing vital insights, facilitating compliance, aiding in decision-making, and fostering growth.

Let's personalize your content