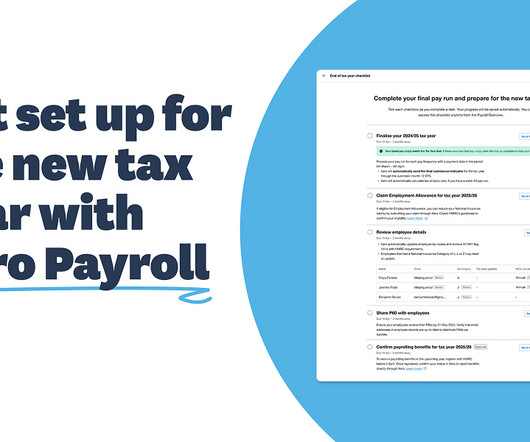

Get set up for the new tax year with Xero Payroll

Xero

MARCH 25, 2025

Finalising your 2024/2025 tax year Wrap up outstanding items Before processing your last pay run for the 2024/25 tax year, approve any outstanding leave requests, timesheets and overtime to ensure your employees’ final pay is accurate. Xero will submit an Employer Payment Summary (EPS) to HMRC once your final pay run is complete.

Let's personalize your content