Accounts Receivable Trends for 2025: Elevate Your Financial Operations

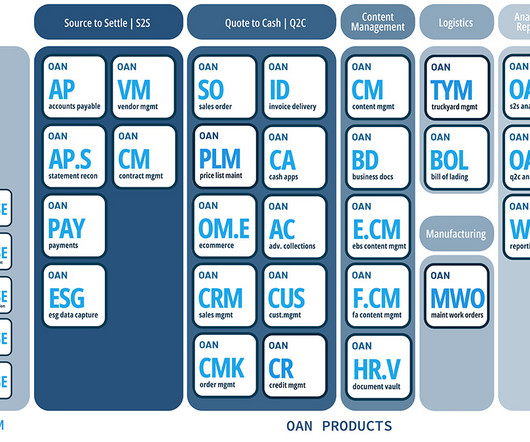

oAppsNet

FEBRUARY 20, 2025

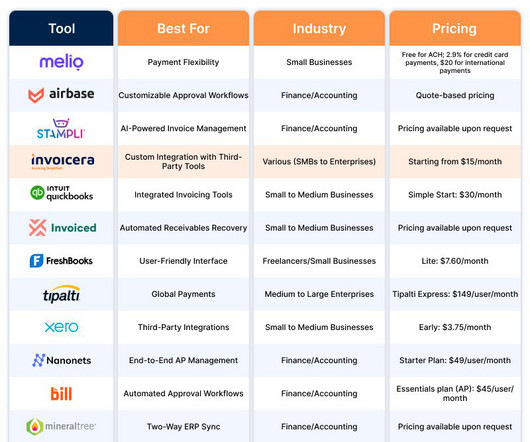

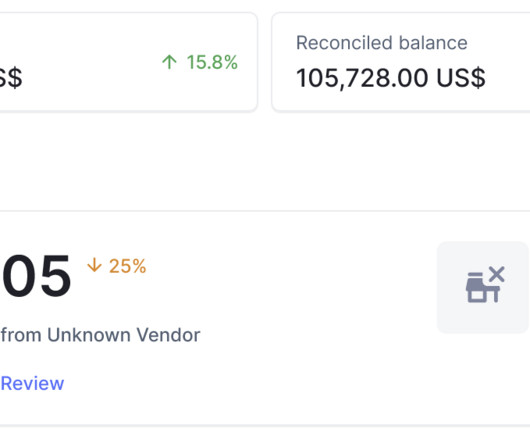

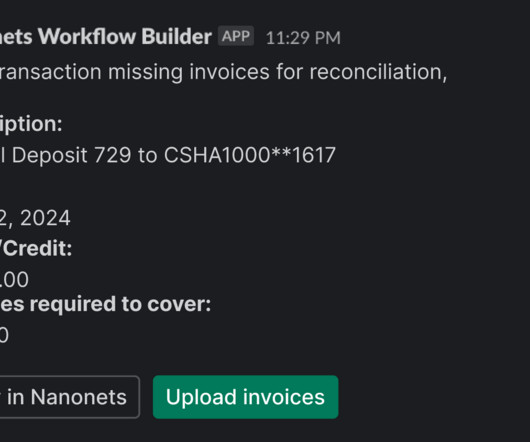

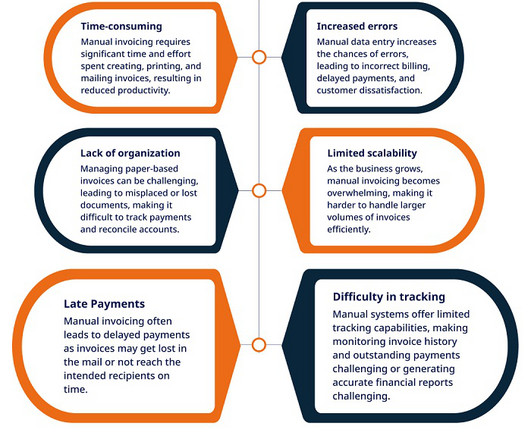

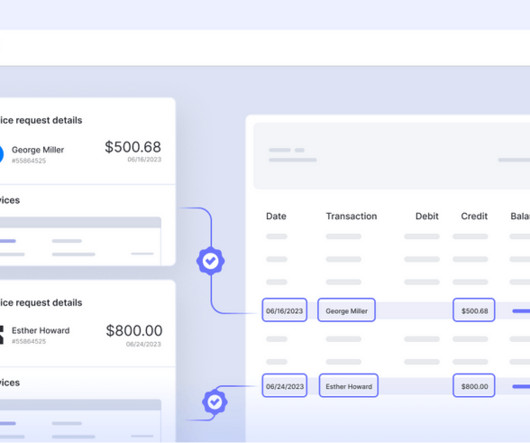

Accounts Receivable (AR) management is a critical area where innovation can significantly impact cash flow and operational efficiency. By embracing the latest AR trends, businesses can optimize receivables workflows, reduce manual errors, and gain real-time insights into their financial operations.

Let's personalize your content