Bookkeeping vs. Accounting: Here’s how they differ

Intuit

AUGUST 30, 2024

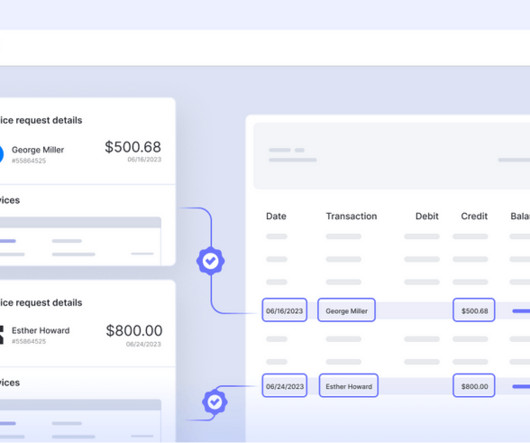

For example, there might be a bucket for income received (sales), another for money spent on supplies (expenses), and accounts for things like cash on hand, money owed to you by customers (accounts receivable), and money you owe to vendors (accounts payable).

Let's personalize your content