Bank reconciliation Vs. Book reconciliation

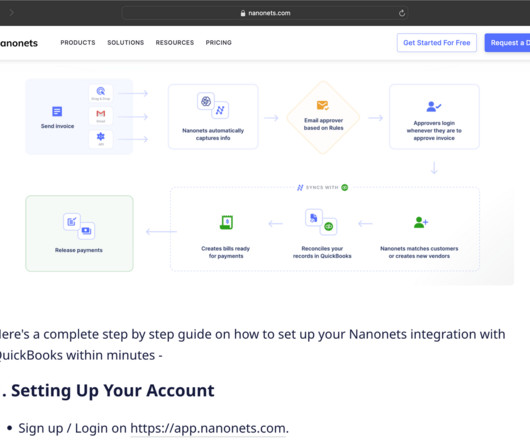

Nanonets

APRIL 12, 2024

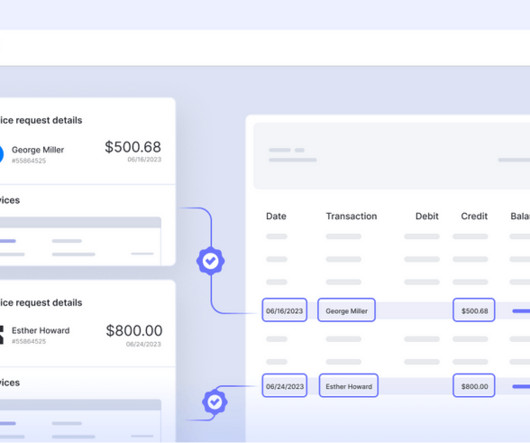

Book Reconciliation entails the comparison of different types of financial records of a company. These records may be internal financial records or external. Companies maintain various internal records to track their financial activities accurately and ensure compliance with accounting standards.

Let's personalize your content