Unlocking the Full Cycle: Why Accounts Receivable Automation Complements Your AP Strategy

Nanonets

DECEMBER 26, 2024

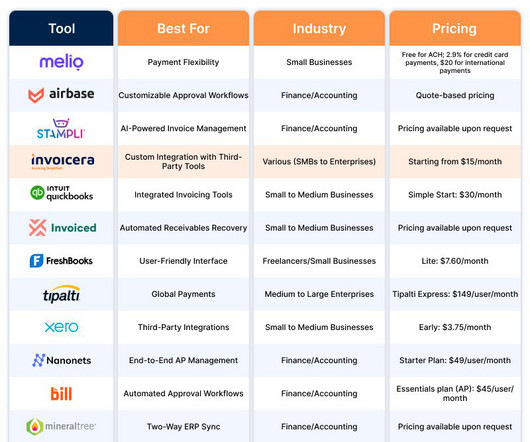

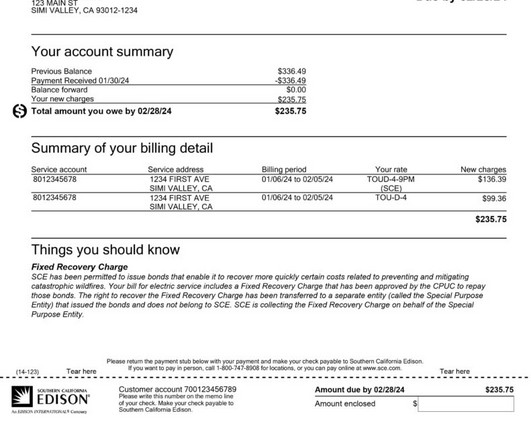

Automation has revolutionized the way finance teams operate, with accounts payable (AP) automation being the go-to first step for businesses looking to improve efficiency and cut costs. But while automating AP is an important step, it’s only one side of the equation. Why AR Automation Complements AP Automation 1.

Let's personalize your content