Types of transaction cycles in accounting

Accounting Tools

MAY 12, 2024

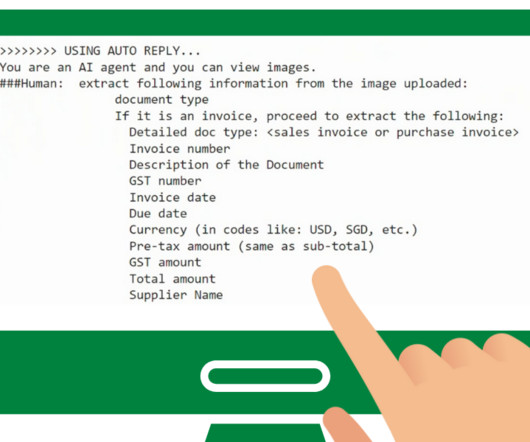

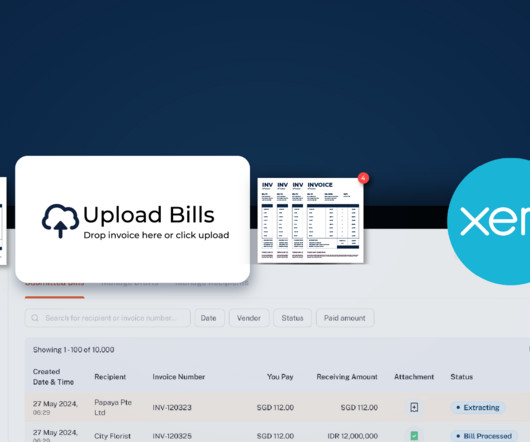

A key role of the accountant is to design an appropriate set of procedures, forms, and integrated controls for each of these transaction cycles, to mitigate the opportunities for fraud and ensure that transactions are processed in as reliable and consistent a manner as possible. We explore the nature of these transaction cycles below.

Let's personalize your content