Receipts and disbursements method

Accounting Tools

MAY 13, 2024

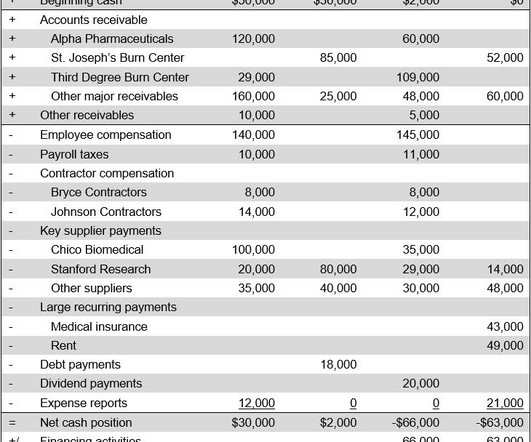

What is the Receipts and Disbursements Method? The receipts and disbursements method is used to construct a cash flow forecast. It is derived from actual and estimated accounts receivable and accounts payable. Within the near term, the results of this method can be quite accurate.

Let's personalize your content