Ghost employee definition

Accounting Tools

APRIL 14, 2024

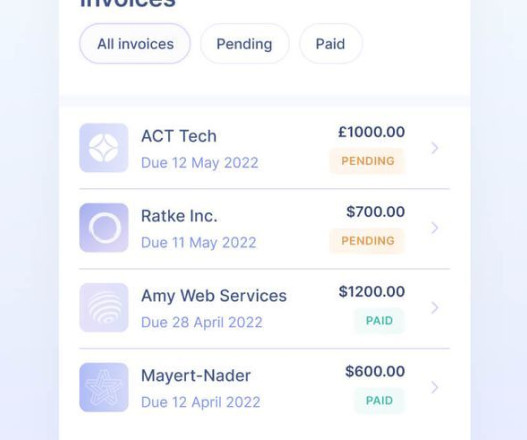

A ghost employee is a person who is on an employer's payroll , but who does not actually work for the company. Someone in the payroll department creates and maintains a ghost employee in the payroll system, and then intercepts and cashes the paychecks intended for this person. What is a Ghost Employee?

Let's personalize your content