Businesses take aggressive tax positions when IRS budget declines

Accounting Today

MAY 31, 2024

Companies retreat to less risky tax strategies when IRS budgets are robust, according to a new study.

Accounting Today

MAY 31, 2024

Companies retreat to less risky tax strategies when IRS budgets are robust, according to a new study.

Counto

MARCH 23, 2025

Tax Filing and GST Compliance Corporate tax filing (Form C-S/C) and GST submissions (for GST-registered businesses) are often charged as flat fees or bundled into service packages. Fixed Monthly Packages Many providers offer tiered packages based on service scope and business size ideal for predictable budgeting.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Counto

JANUARY 21, 2025

Heres why you should consider working with an accounting firm: Broad Expertise: An accounting firm brings together professionals with expertise in various areas, such as corporate tax, GST, financial audits, and compliance. This broad skill set ensures that your business receives well-rounded financial guidance and advice.

Counto

NOVEMBER 10, 2024

What to track: Monitor all employee-related costs, taxes, and other business expenses to ensure compliance with Singapore’s tax requirements. Preparation for Audits Why it’s important: Well-maintained records ensure that your business is prepared for audits and can quickly provide the necessary documentation when required.

Counto

SEPTEMBER 7, 2024

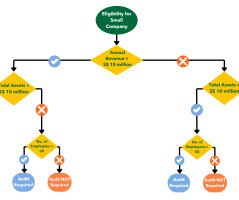

Understanding Audit Requirements for Private Limited Companies in Singapore As a private limited company in Singapore, understanding audit requirements is crucial for maintaining financial transparency and compliance. What is an Audit? Changing auditors can bring fresh perspectives and enhance audit quality.

Counto

JANUARY 13, 2025

This can be especially valuable for new businesses that need to manage tight budgets. Additionally, many digital platforms undergo regular audits to ensure compliance with industry standards, which can help businesses feel confident in their digital banking solutions.

CapActix

FEBRUARY 27, 2025

Also Read: A Comprehensive Guide for IRS Business Tax Extension Step 1: Gather Essential Business Documents Filing a business tax return online starts with preparation. Rushing into the process without the necessary documents is a guaranteed way to cause delays, errors, or even trigger an IRS audit.

Let's personalize your content