Bank reconciliation Vs. Book reconciliation

Nanonets

APRIL 12, 2024

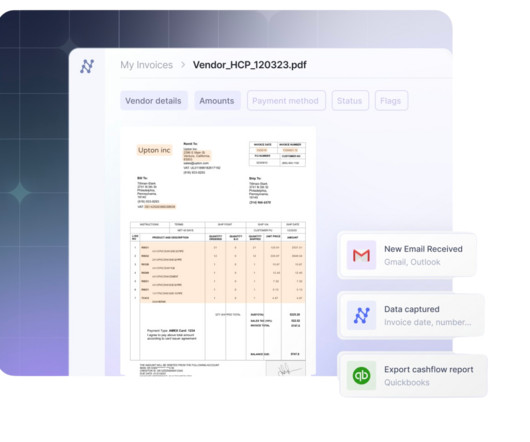

Accounts Receivable Reconciliation : Accounts receivable records are reconciled by comparing the balances in the accounts receivable ledger with the amounts listed on customer invoices and statements. Once identified, these discrepancies are investigated and reconciled to bring the two balances into agreement.

Let's personalize your content